Seasons Greetings & Is The Taxpayer Funded Jobs Printer Going Global?

Comparing non-market jobs growth across the Anglosphere

As this year draws to a close, I just want to take a moment to say thank you to everyone who is a paid subscriber or has made a contribution throughout the year.

We hit over 3,000 total subscribers recently and the readership and support of every last one of you is immensely appreciated.

I wish you all a Merry Christmas, a Happy Holidays and all the best for the coming year.

In the spirit of the season this article will be free to all subscribers until after the holidays when it will be partially paywalled.

After recently going through the Australian statistics on job creation in overwhelmingly government funded industries (public administration, healthcare and social assistance, and education and training) representing more than half of all post 2007 job creation, it made me wonder to what degree was taxpayer funded job creation a factor in other nations?

To explore this question we’ll be looking at numbers from throughout the Anglosphere, aka the U.S, Canada and the U.K, along with a late entry from New Zealand. Overall the characterizations are the same or very similar in headline terms with the exception of the U.S which uses somewhat different terminology. The U.S also has a higher proportion of people employed by government inherently due to the duplication of some roles across multiple levels of government (city, county, state, federal).

The Starting Point

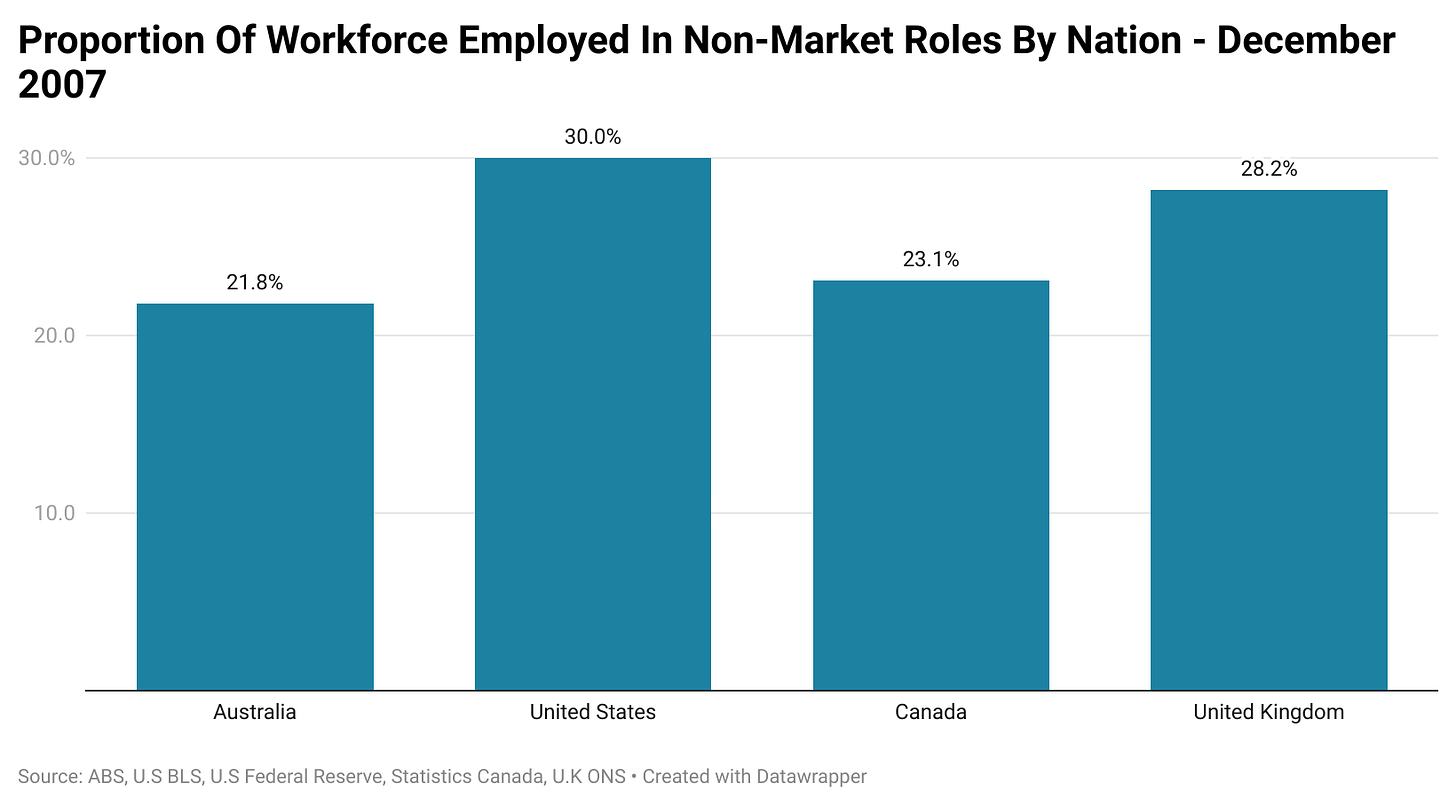

Our story begins in December 2007, the month that the U.S National Bureau Of Economic Research conclude marks the start of the ‘Great Recession’. At this point 30.0% of U.S jobs were in non-market roles, 21.8% in Australia, 23.1% in Canada and 28.2% in the U.K. The Stats New Zealand data on this kicks off in the June quarter of 2011, at which time 27.3% of jobs were in non-market roles.

With the U.S and U.K already holding significantly more non-market jobs as a proportion of the workforce, the scope for expansion was significantly more limited than it was for a nation like Australia or Canada which had a much smaller proportion of workers in those roles.

USA - An Inherently High Base

At the outset the U.S held the title of most non-market based jobs, arguably due to the duplication of roles across multiple layers of government and potential definitional differences.

History tells us that the U.S also held the most limited upside for the growth in largely government funded employment. The pre-Covid peak proportion of American workers in non-market based jobs occurred in the September quarter of 2012, when 32.7% of Americans were employed in those sectors. As of the September quarter of this year, 31.4% of Americans are currently employed in non-market based sectors.

Its also worth noting that in several major instances in the assessed period (Great Recession and Covid-19), the increase in non-market jobs as a proportion of overall employment was heavily a result of job losses in the private sector and shrinkage of the overall American workforce, not an outsized expansion of non-market employment.

Britain - Our Current Champion

When David Cameron and the Tory Party came to power in Britain in 2010, they brought with them a policy of austerity. Cameron claimed that the Conservatives would slash wasteful public spending and end the rise of what has become known today as “bulls*** jobs” in the public sector.

In reality, jobs in non-market sectors as a proportion of overall employment stayed within a relatively tight range of 28.8% and 30.1% of the workforce over the coming decade up until the pandemic.

Since the pandemic the level of non-market employment in Britain has a hit a new all time high, both for Britain and the Anglosphere more broadly. It is arguably the bellwether for the limit of what proportion of jobs can be in heavily taxpayer funded industries. With budgetary constraints increasingly a factor and various unpopular tax increases tabled by the Starmer government, if a limit to non-market employment is to be found any where any time soon, it will be in Britain.

Overall, the total proportion of employment in Britain stemming from non-market jobs has risen from 27.6% in Q4 2007 to 32.5% as of the most recent data.

Australia - The Largest Growth

In the 13 years prior to the GFC, the proportion of Australians in non-market roles moved in a relatively tight range, between 21.7% and 23.0% of workers. But after the Financial Crisis arrived on Australia’s shores, the makeup of job creation was dramatically changed forever.

In the years since, non-market based jobs growth has represented a majority of overall employment growth, compared with under a quarter prior to the global financial crisis. As of the latest annual figures just 17.2% of new jobs in the last 12 months were outside of industries generally defined by taxpayer funded employment growth.

Between the start of our snapshot in December 2007, the proportion of Australian workers in non-market roles has risen from 21.8% to 29.9% as of the latest data.

Of all the countries assessed today this is by far the largest growth in the proportion of non-market jobs relative to the labour force.

While Australia began this analysis with the greatest scope to expand its generally taxpayer funded employment sectors the most, the overwhelming majority of that scope has already been used up. That being said the level of scope for growth is in the eye of the beholder, one can after all pursue extremely high levels of non-market jobs growth despite its costs as evidenced by our next contender, Britain.

Canada - A Mixed Bag

In recent months, the Canadian government has been copping flak that the majority of jobs growth that has occurred since the pandemic has been driven by public sector employment. In terms of today’s metric, 53.8% of jobs created in net terms since December 2019 have been in non-market roles.

If we take a step back and examine Canadian non-market jobs growth since the start of the GFC, it swiftly becomes clear that the Canucks are in the same boat as Britain and Australia. Since Q4 2007, the proportion of the Canadian work forced employed in a non-market role has risen by 4.1 percentage points.

Canada and Australia are arguably stuck in a similar feedback loop. Between capital being increasingly sucked into the housing market and poorly targeted migration, productivity growth is going no where fast, further incentivizing the creation of taxpayer funded jobs in order to grow the economy and prevent a rise in unemployment.

New Zealand - A Late Entrant

While New Zealand’s data is roughly four years late to the party compared to the other nation’s compared today and that plays a role in it emerging as our winner for the smallest expansion of non-market jobs growth relative to overall employment, when looking at it through a different lens its performance is similarly impressive.

If we shift our starting point to Q4 2019 and instead assess the performance since then, New Zealand emerges as the nation with the second lowest expansion of non-market employment relative to the overall workforce.

While New Zealand arguably does have the scope to expand the relative level of non-market employment if it chose to in the longer term, its revenue base lacks the same boost afforded to nations such as Canada or Australia with their mineral wealth.

With a budget deficit forecast for 2024-25 in excess of 4% of GDP (historically very high by Kiwi standards), in relative terms there isn’t currently much rope for the New Zealand government to expand non-market jobs at the rate seen elsewhere.

Another Perspective - Post Pandemic

While Canada, Britain and Australia have all become more reliant on non-market based employment to varying degrees since the GFC, the pandemic acted as a catalyst to send this growth into overdrive.

Since the pandemic non-market employment as a proportion of total employment has risen by 0.6% in the U.S and 1.19% in New Zealand. In the nations more reliant on taxpayer funded employment growth, the ratio has risen by 1.91% in Canada, 2.46% in the U.K and 3.75% in Australia.

Looking at the more recent numbers in a vacuum, there is little sign of a slowdown in taxpayer funded employment growth in Australia, Canada or Britain. Given the increasing pressure the Treasury’s of all three nation’s face, one wonders how much longer this trend can continue.

The Complete Picture

Despite its reputation for at times using public sector job creation to help support the labour market, the U.S has seen the proportion of workers in non-market jobs remain mostly stable for the last two decades.

While the level has at times surged due to falls in private sector employment and a brief surge in public sector workers during the pandemic, overall the U.S has actually done an admirable job in not becoming overly reliant on taxpayer funded job creation relative to where it was almost two decades ago.

The U.K on the other hand has taken reliance on non-market jobs growth a step further toward its logical conclusion, becoming by far the most reliant on non-market employment to support its economy in aggregate.

Canada saw the same surge in non-market jobs present in the other assessed nations and has since seen this form of job creation become a major factor in its labour market. One wonders if it had experienced the same enormous fiscal windfall as Australia in the last few years if it would be vying for the lead in post-pandemic non-market jobs growth.

As for Australia, its mineral wealth and ongoing neglect from government in adequately expanding infrastructure and services at a state and federal level gives it scope to continue to grow the ranks of industries where employment is overwhelmingly taxpayer funded.

Despite proposed reforms, the National Disability Insurance Scheme is still expected to continue to balloon in cost, along with the level of employment dedicated to it. In time, this trend is increasingly likely to see Australia come to challenge the U.S and eventually Britain as the most reliant Anglosphere economy on employment in generally taxpayer supported industries.

Unlike the other assessed economy’s which saw a surge in non-market jobs during the pandemic and then largely saw growth begin to level off, Australia’s has seemingly become addicted to taxpayer funded employment growth. Looking at the chart of the growth in the size of non-market employment relative to the overall workforce since 2007, Australia stands alone.

This is not a new development, but the conditions have seen it taken toward its logical conclusion. Ultimately, history suggests its likely to end badly and like Britain during the age of austerity, some of those who really need assistance may miss out as entrenched vested interests move to protect their government funded income streams.

— If you would like to help support my work by making a one off contribution that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my paid Substack, Thank you.

A similar comparison between countries based on the proportion of adults deriving their main income from taxpayers would be interesting, ie govt jobs + social security. I heard it was over 50% in the anglosphere, but how much over?

To take this further, (after seeing first hand the deterioration of health care in New Zealand) can you breakdown in the data the difference between woke DIE initiatives to public services eg police/ healthcare?