Kamikaze Bank Of Japan Policy And After Shocks For The World

A basic breakdown of the implications for the BOJ's changes to yield curve control

In the history of Japan, the Kamikaze or ‘Divine wind’ holds a revered place for saving Japan from two Mongol invasions in the late 13th century. Both times the Mongols attempted a seaborne invasion their fleets were decimated by typhoons, arguably saving Japan from Mongol subjugation.

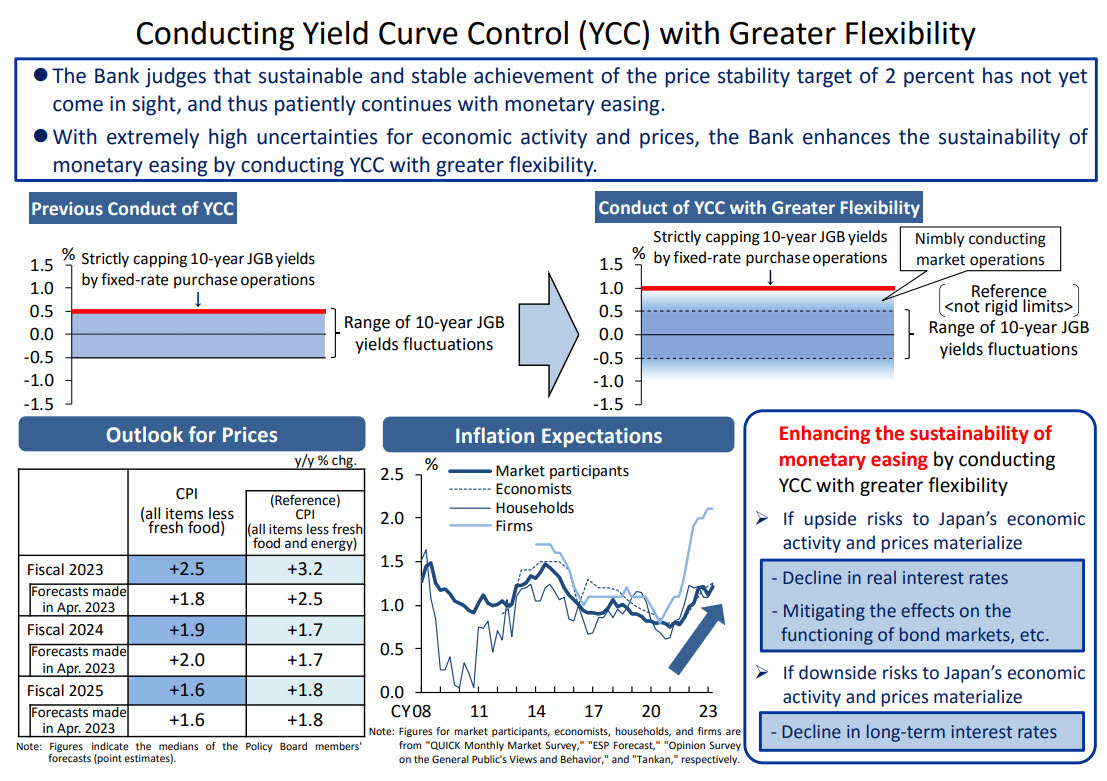

On Friday, another wind of profound change came blowing in from Tokyo, as the Bank Of Japan abandoned their 0.5% hard cap on the Japanese 10 year government bond yield, raising the cap to 1.0%. To avoid this new cap from being exceeded, the BOJ committed to buy as many 10 year government bonds as needed to maintain its new line in the sand.

While it may not sound like a major change on paper, the implications for global markets are potentially highly significant.

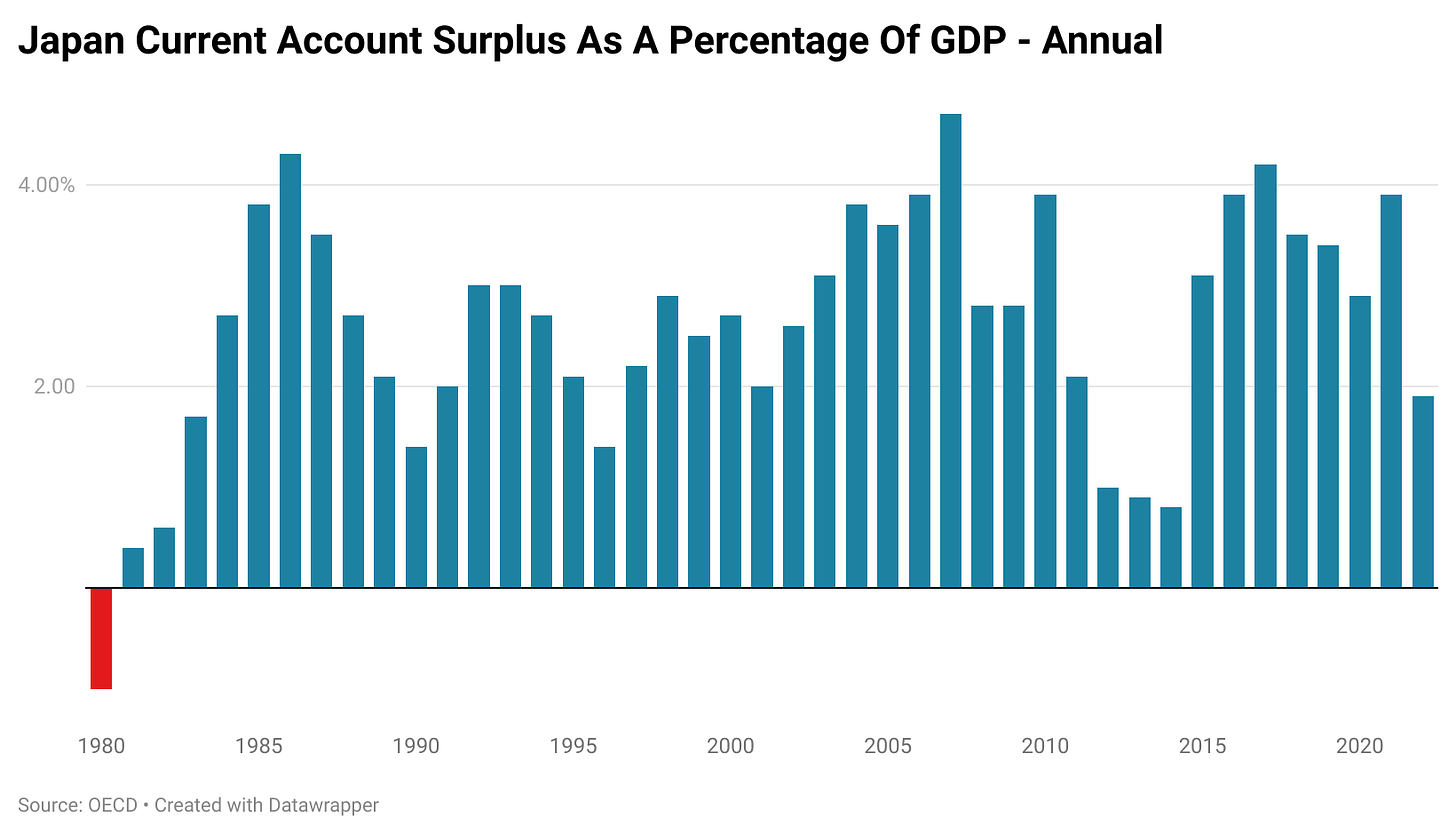

As a nation with a long history of running a current account surplus (aka a net lender to the rest of the world), the excess savings of Japanese households and corporates flow into asset markets throughout the world.

The benchmark for the returns on these external investments are generally Japanese government bond yields. Over the years using Yen to buy foreign bonds at significantly higher yields than those on offer at home has been a popular way to overcome the extremely low interest rates that have come to define the Japanese experience.

During the 1990s and 2000s, Japanese households became major movers of currency markets as they borrowed Yen and then converted it into a foreign currency such as the Australian dollar in order to get a higher interest rate on those savings. This carry trade nicknamed ‘Mrs Watanabe’ after a popular Japanese surname, became famous for influencing currency markets.

But now as benchmark Japanese government bond yields attempt to find a new equilibrium without the BOJ buying a potentially unlimited number of bonds at a 0.5% yield on the 10 year, the calculus for all manner of investments made by Japanese households and corporates may change dramatically.

For example, where once a U.S government bond held with a hedge back into Yen was attractive at a certain yield, the requirement for the same relative return above a Japanese government bond of the same duration now means the U.S bond yield needs to be higher to maintain its appeal to Japanese investors.

It is not only Japanese investors who use Japanese government bond yields as a benchmark. Japanese government bonds are considered to be among the safest in the world, so they are benchmark for bond traders throughout the world.

With that benchmark now in flux and with the potential for it to double from where it was prior to the recent change, global bond markets will now need to find a new equilibrium in the coming weeks and months. Bond markets are the foundation under which all other asset markets are built and on a long enough timeline eventually priced against.

From central bank interest rate deliberations to the value of currencies around the globe, this change will shift the calculus as all eyes focus on where the Japanese 10 year finds its new equilibrium, without the expectation of immediate BOJ intervention once it tried to peek above 0.5%.

Bank Of Japan’s Challenging Choice

The Bank of Japan was presented with a challenging choice, they could either allow continued downward pressure on the Yen as Japanese government bond yields remained unfavourable relative to those on offer elsewhere. Or they could take the path they have chosen and by letting bond yields rise, hopefully taking pressure off the Yen and buying time.

While there is all manner of analysis out there detailing how badly the Japanese government would struggle with higher borrowing costs over a long term time horizon, this somewhat misses the forest for the trees.

The BOJ and the Japanese government don’t need to maintain this new status quo forever, just long enough for the next major economic downturn to arrive, at which time investors will buy safe haven long duration assets such as government bonds.

The Reality

Since implementing the change to the 10 year bond yield cap, the Bank of Japan has already intervened in the market twice. In both instances it committed to buying an unlimited number of 10 year Japanese government bonds to stop yields from rising from swiftly.

This appears to be a sign of things to come.

While the BOJ is okay with the 10 year yield slowly drifting higher, its ascent so far has been anything but pedestrian. So far it has hit 0.65% and taken a break amidst the BOJ’s latest round of intervention.

But one imagines this cat and mouse game between the bond market and the BOJ will continue until there is either a flight to safe haven assets or the new cap of 1.0% is reached, at which time the BOJ have a whole new problem.

In terms of broader markets, the change to the BOJ’s yield target could scarcely have come at a worse time. The U.S Treasury is set to ramp up the issuance of longer dated securities, with the quarterly refunding of long term treasuries coming in at $102 billion.

Unsurprisingly U.S long bond yields (10 year duration or more) have surged since the BOJ’s announcement, hitting their highest level since November of last year.

Its worth noting that both times U.S long bond yields have surged in the past 12 months, things have gone awry in the financial system. Back in October it was the British bond market which saw signs of profound stress and required the Bank of England to step in the calm the situation. In March, it was U.S regional banks where stress was centred and once again required central bank intervention to restore confidence.

Implications For Australia

Since I have a feeling I will get a few questions on this, I’ll cover it briefly here. For decades Australia has benefitted from Japanese investors buying Australian government bonds, stocks and dollars, putting downward pressure on bond yields and upward pressure on the AUD.

Depending on how much Japanese government bond yields rise from here, the Australian dollar may be left in an increasingly vulnerable place. It did not react well to the announcement and already faces a long list of other downward pressures, perhaps most notably the spread between overnight interest rates in Australia and the U.S blowing out back to record highs following the last Fed meeting.

The RBA has briefly mentioned the strength of the AUD as a factor in its decision making in the recent past and its possible that an evolving global equilibrium may put further upward pressure on interest rates.

If we see a protracted risk off move in global markets, particularly one driven by higher global bond yields, pressure may rise to bring Australian rates more in line with those in the U.S and elsewhere.

The Winds Of Change

Ultimately the change to the BOJ’s yield curve control is currently only about a week old and where we go from here is filled with uncertainty. In time a new equilibrium will be found in Japanese bonds and within the bond market more broadly.

But with the BOJ stepping in frequently to slow the 10 year yields ascent, it may be quite some time before this new equilibrium is reached.

In time this wind of change may be swept up in a maelstrom of greater global economic forces and cancelled out by a flight to safe haven assets, such as Japanese government bonds and holdings of Japanese Yen.

But the longer the current economic expansion cycle continues and the longer inflation remains elevated, the more likely it becomes that a repricing of Japanese government bonds will echo through asset markets around the globe.

The Bank Of Japan and the Japanese government can endure higher rates in the short to medium term. But for currencies and markets reliant on low Japanese interest rates to help underpin their strength, things may get quite a bit more challenging in time.

— If you would like to help support my work by making a one off donation that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my Substack or via Paypal here

Regardless, thank you for your readership and have a good one.