Kamala Harris First Home Buyer Grant - History Is Not On Its Side

History shows grants delivering higher prices, not higher home ownership rates

As more and more articles and analysis emerge on the housing plans of Vice President and Democratic nominee for the Presidency Kamala Harris, one can’t help but be struck by how often the proposed policy is being approached as something in the abstract.

Its like Australia and the other nation’s where similar subsidies have been implemented simply don’t exist, along with the decades of evidence compiled by economists, government and academia.

What Is Being Proposed?

While the Harris campaign has not yet released the full details of the plan, the broad strokes we have so far reveal an up to $25,000 grant for a down payment for eligible first home buyers, as well as an additional $10,000 tax credit for those who qualify.

In order to provide some perspective on the historic impact of grants similar to those proposed by Harris, we’ll be looking at over 20 years worth of data on how housing affordability evolved following their implementation and what some of the various research papers concluded was the result.

The two instances which we’ll be looking at in detail are:

The Howard governments first home owner grant, which provided up to $14,000 to eligible buyers starting in March 2001.

The Rudd government’s doubling of the first home owner grant to $14,000 for eligible buyers in the wake of the Global Financial Crisis in October 2008.

We’ll also examine how the proposed grants and tax credit stacks up against the median house price in the various U.S states, in order to gain some perspective on where it could have the most outsized impact.

For Political Gain - Howard Government First Home Buyer Grant

In March 2001, the government of then Prime Minister John Howard found itself in a challenging political position. It was 14 points behind in the two party preferred polls (57 to 43) with an election coming up in the second half of the year and had just lost the formerly safe ‘blue ribbon’ seat of Ryan to Labor in a byelection.

With things looking challenging and with another vital byelection coming up, this time in the seat of Ashton, Howard was seeking a quick fix to his political ills.

One of the those fixes was a cut to the fuel (gasoline) excise tax and a temporary freeze on indexing the tax to inflation, which ended up lasting 15 years.

But the big one was the introduction of the Howard government’s $14,000 first home buyer grant. You can quite literally see on a chart of polling from the era that this was part of the beginning of the shift back toward to the Howard government, that would with the aid of the events September 11th deliver the Coalition another term in office.

When comparing the size of the various Australian first home buyer grants across time relative to the purchase price of a home, the Howard government’s is the closest to those proposed by Harris.

Amidst an environment of cuts to interest rates following the Dot Com bust and the introduction of the capital gains tax discount, which would become a favourite tool for property investors, the Howard government’s first home buyer grant played a role in driving the largest expansion in real housing prices in the almost 50 years of Dallas Fed data on the metric.

Over the next 3 years housing prices rose by over 50% in real terms, putting an end to the last real era of widespread affordability and a relatively attainable down payment hurdle (when not having ones down payment balance boosted with government cash).

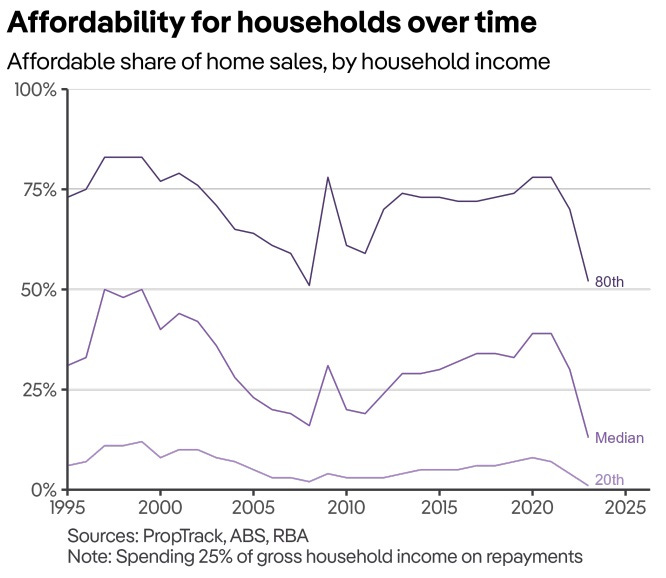

In an analysis from property data firm PropTrack, it was concluded that in the year prior to the grant being implemented, a household on the median income could afford the median house. And a household with an income in the 80th percentile could afford a home in the 80th percentile by value. Today, the median household nationally can afford only 13% of homes being brought to market.

Rudd To The Rescue

When the Rudd government introduced its own $14,000 first home buyer grant in 2008, it too was looking for a solution to an entirely separate problem despite running on a platform that had a heavy emphasis on affordable housing in the election in the year prior.

“This short-term stimulus was designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market”

Amidst an economy defined at the time by rising unemployment and narrowly avoiding recession only as a result of record high levels of net migration, the Rudd government’s grants did not have the same level of impact on property prices as that of their predecessor. They did however succeed in accomplishing the government’s goal of preventing the housing market from collapsing and in doing so further propelled property prices higher.

While the $14,000 grant was in place for under 12 months, in the 15 months from shortly before its inception to 3 months after its end, capital city housing prices rose by an average of 17.3%.

A Greater Risk In America

The risk of the U.S property market having an outsized reaction compared to Australia is also quite high. According to a report from the National Association of Realtors, the average down payment for a first time home buyer in 2023 was 8% of the purchase price.

In Australia, the historical norm for a down payment was 20% down unless a borrower paid lender’s mortgage insurance or had some other means of reducing the requirement, such as a mortgage with parents going guarantor.

So right off the bat, more Americans would be able to pull the trigger on purchasing a home with the proposed grants compared with Australians experiencing a similar windfall.

Based solely on the $25,000 grant, a prospective first home buyer could go out and purchase the median house in 23 out of 50 U.S states. And we are not talking solely states in the mid-West with relatively low populations. Large, populace states such as Texas, Pennsylvania, Illinois and Ohio are all on the list. In total over 146 million Americans live in states where a $25,000 grant would act as 100% of the required down payment on the median house for a first time buyer.

If we include the $10,000 tax credit as part of the down payment, the number of states where the grant and tax credit could get a prospective buyer into the median house assuming they had the income to service the mortgage rises to 38 out of 50 states. The total number of people in states where this would act as an actionable down payment on the median house rises to over 230 million people.

The lower average down payment hurdle and a long list of housing markets in which the grant would act as an immediately actionable means of purchasing a home could easily serve to drive prices up to a far greater degree than the $25,000 or $35,000 initial cash injection would imply. Like Australia in 2001 and 2008, there is also the potential for lower mortgage rates to also play a significant role as the Federal Reserve cuts interest rates, putting further upward housing prices.

The Research

In 2012, David Blight, Michael Field and Eider Henriquez then of Deakin University authored a paper on the impact of First Home Buyer Grants from the year 2000 to 2010.

They concluded that First Home Buyer Grants added $57,321 to the cost of the median housing price, which was at the time $360,000. In short, a little under 16% of the total value of the median home at the time was concluded to be as a result of the First Home Buyer Grant, despite the grant itself being significantly smaller than that figure.

In their analysis Blight, Field and Henriquez also included a fascinating graph, in which real Australian housing prices were charted across time, along with each instance of various first home buyer subsidies being implemented.

They noted in the paper: “Figure 4 shows the link between house price index pricing at the time of the issuing of the FHBGs (first home buyer grants). Each time a FHBG is offered, there is a corresponding increase in the real house price index over the following period.”

In 2022, the Australian federal government’s Productivity Commission produced a report on the impact of first home buyer grants and other support mechanisms to get first home buyers into the housing market.

"It is not typically home buyers who benefit from the assistance, it is the sellers who receive a higher sale price,"

"What this means is that assisting home buyers can make housing less affordable, particularly for people who do not qualify for assistance." the report stated.

In an interview with ABC News following the release of the report Commissioner Malcolm Roberts concluded that:

"The demand for those services (homelessness) is continuing to rise and there are a lot of people seeking help who cannot be supported. We feel there is better social return from supporting people who are in greater need," Roberts said.

A Reality Check

While first home buyer grant’s do achieve the promise on the metaphorical box, they do so in such a way that every other first home buyer who comes after finds a higher price of entry, as illustrated by the data in the paper from Deakin University.

While first home buyer grants completely fail to deliver affordable homes for first time buyers in the long run, what they do succeed in doing is delivering a political dividend to those who employ them at the right time in the electoral cycle and help to prevent downside in the housing market, which could otherwise have economic effects that could be politically damaging.

For Kamala Harris and her compatriots, perhaps this is enough, after all both sides of Australian politics have used these same means to further their political goals and have been quite pleased with the consequences, despite the long term costs to market entrants who come after.

Given the unique position of the United States regarding down payment sizes and the large number of housing markets where this grant could have borrowers almost immediately pulling the trigger on purchases, risks are high that the grant could have an even more outsized impact than Australia has seen in a vacuum.

There is arguably a set of circumstances in which there is enough housing supply coming to market for these sorts of grants to not have an outsized and negative impact, at least in principle. But ultimately that is not the circumstances the Untied States now finds itself in after several years of depressed housing transactions due to higher mortgage rates.

— If you would like to help support my work by making a one off contribution that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my paid Substack