With the release of the latest ABS employment figures the prevailing narrative surrounding the labour market has been seriously brought into question. The broader expectation was for jobs growth and labour force growth to slow in relative tandem, keeping any rise in unemployment contained.

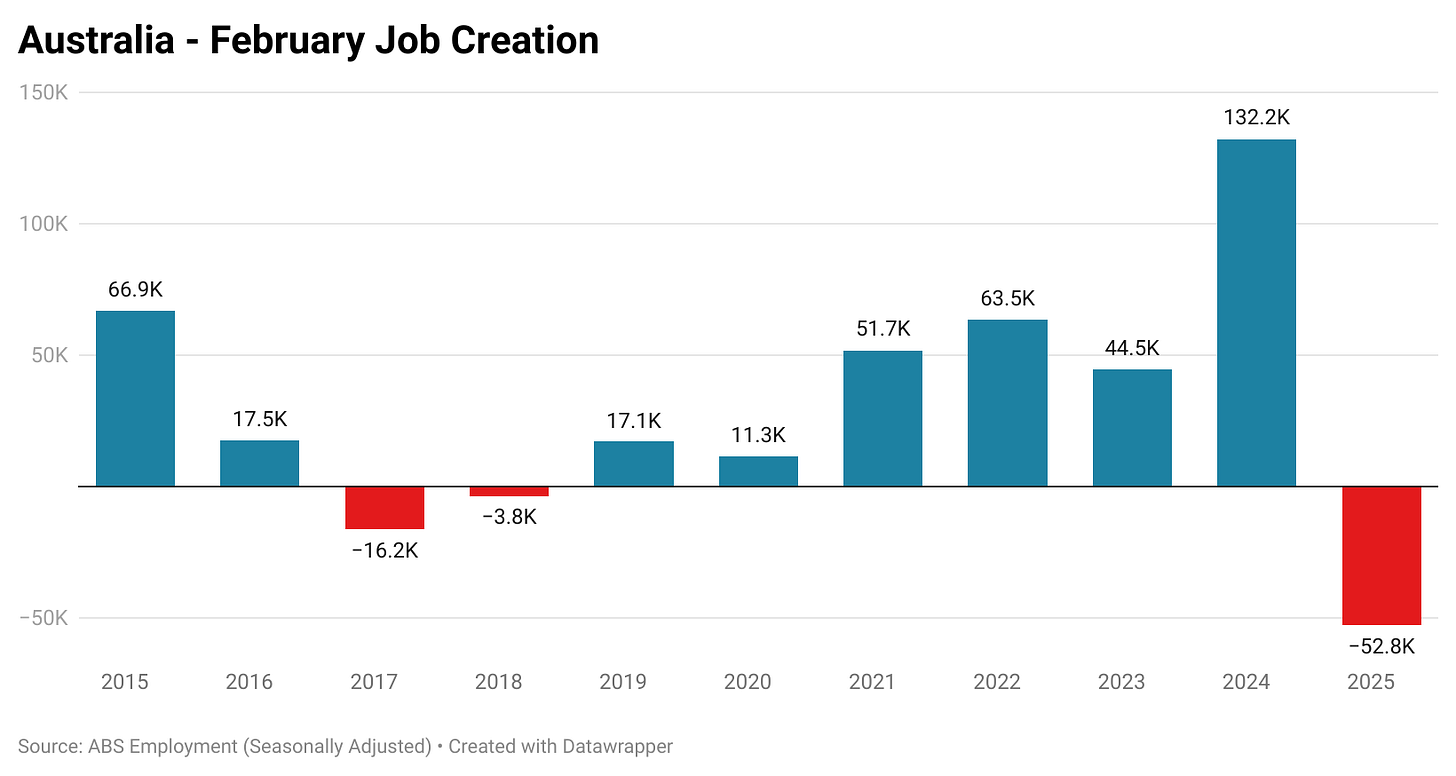

Instead, the loss of 52,800 jobs in February, 35,700 of them in full time positions, was a shock to the market and analysts who were expecting an expansion of 30,000 jobs.

Which begs the question, how did we arrive at such a figure and is it a sign of things to come. My first thought was that it was potentially at least partially related to issues of seasonality or driven by sample rotation to some degree (the sample rotated in was actually very similar to the one rotated out).

First off we’ll be looking at the headline seasonally adjusted figures, before taking a deeper dive into the raw data to see what that can tell us.

Headline Numbers

Looking at month on month jobs growth figures for the decade of February’s prior to 2025, an average of 38,500 jobs were created, with the highest figure 132,200 in February 2024 and the lowest a loss of 16,200 jobs in February 2017.

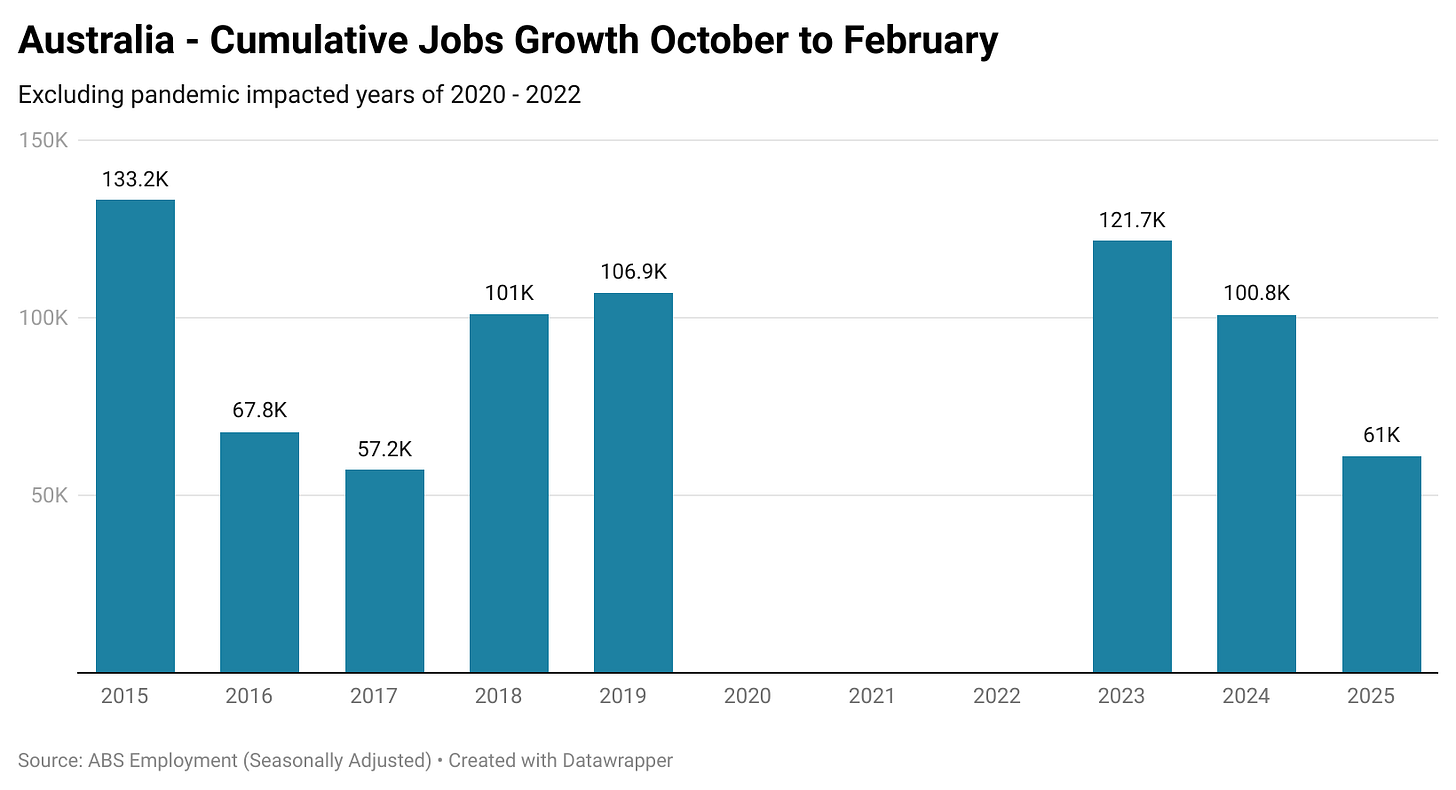

If we take a step back and look at the October to February period as a cumulative block in an attempt to avoid as much noise in the data stemming from seasonality as possible, in the decade prior to 2025 (excluding pandemic 2020-22) an average of 98,400 jobs were created across this time period. From October 2024 to February 2025, 61,000 jobs were created.

While 61,000 jobs over a four month period under more normal circumstances would be a performance on the poor side of normal, when the working age population has grown by over 172,000 across the same time period, its just not enough to prevent a significant rise in unemployment.

Raw Data Viewpoint

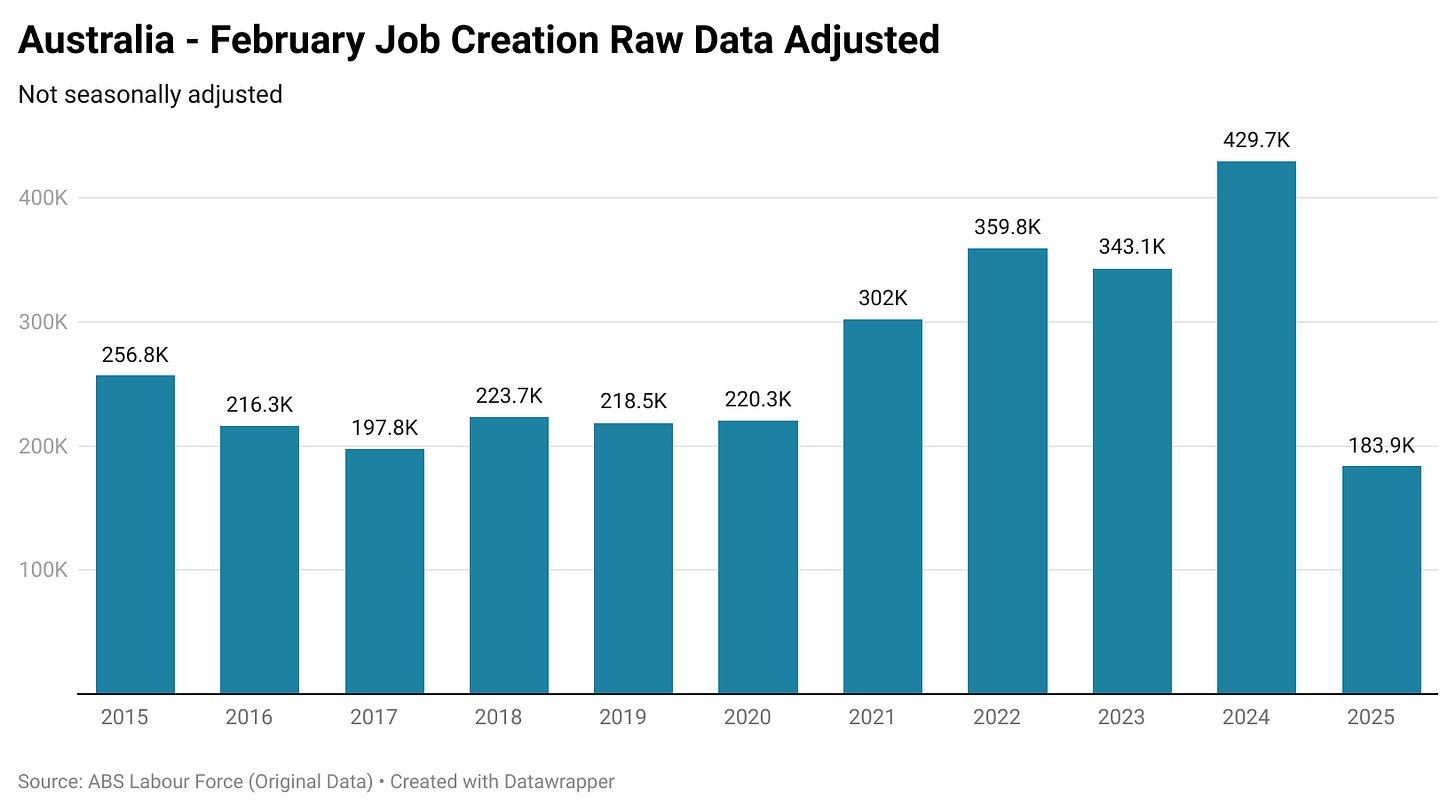

Looking at the raw data, in February 183,900 jobs were created, the lowest number for a February in over a decade. In the decade prior an average of 276,800 jobs were created in February’s.

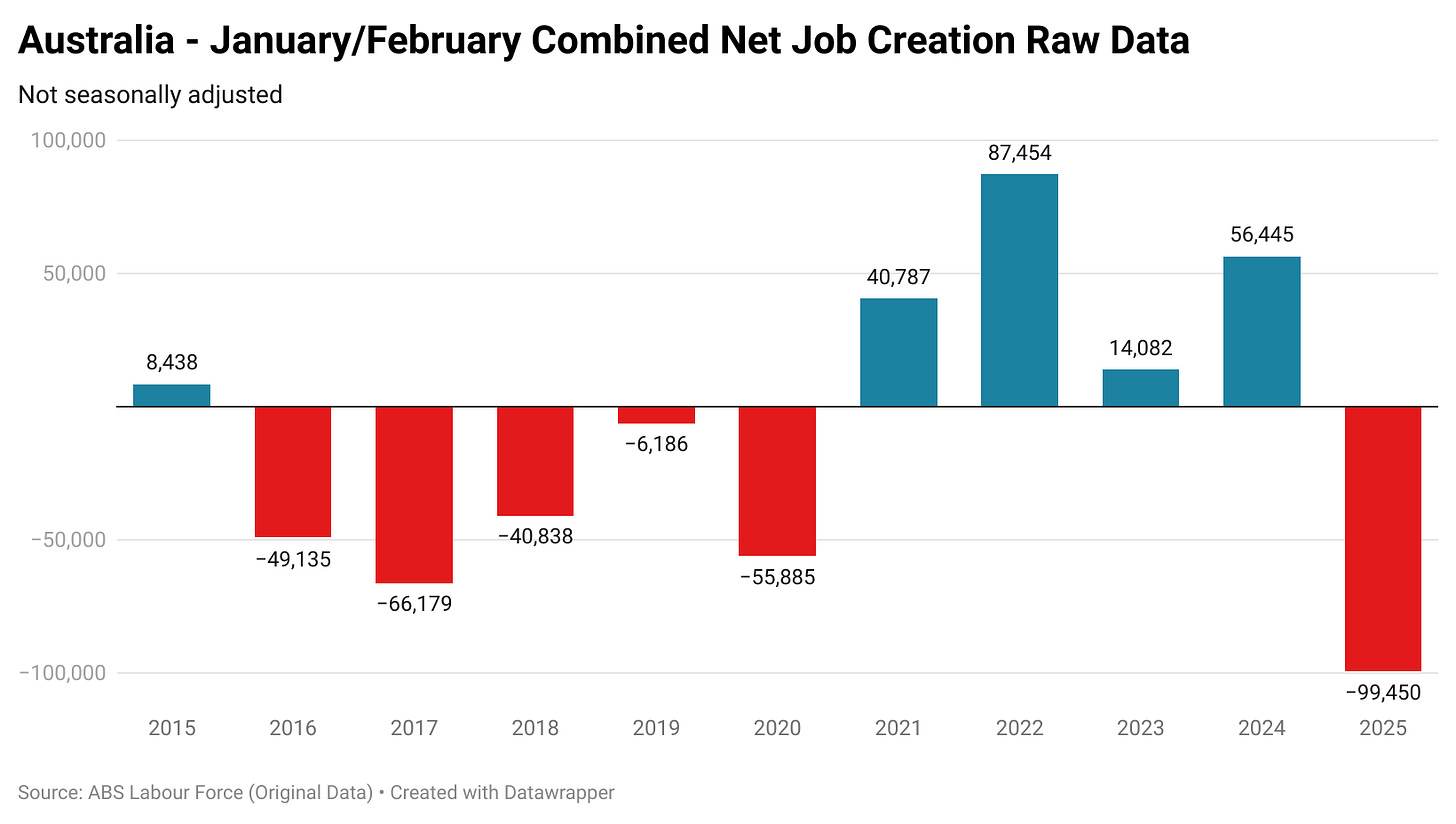

In order to smooth out potential shifts in seasonality, a net figure for January and February combined was then assessed, since January sees large job losses due to seasonality. On this combined metric, February 2025 also put in the weakest performance in over a decade, with 99,400 jobs being shed in net terms compared with an average 1,100 jobs being lost.

The Takeaway

So far it’s just one jobs print indicating a significant degree of weakness for the labour market and should be approached with a high degree of caution, particularly when put into the context of previous deteriorations, which ended up being little more than statistical blips in the long run.

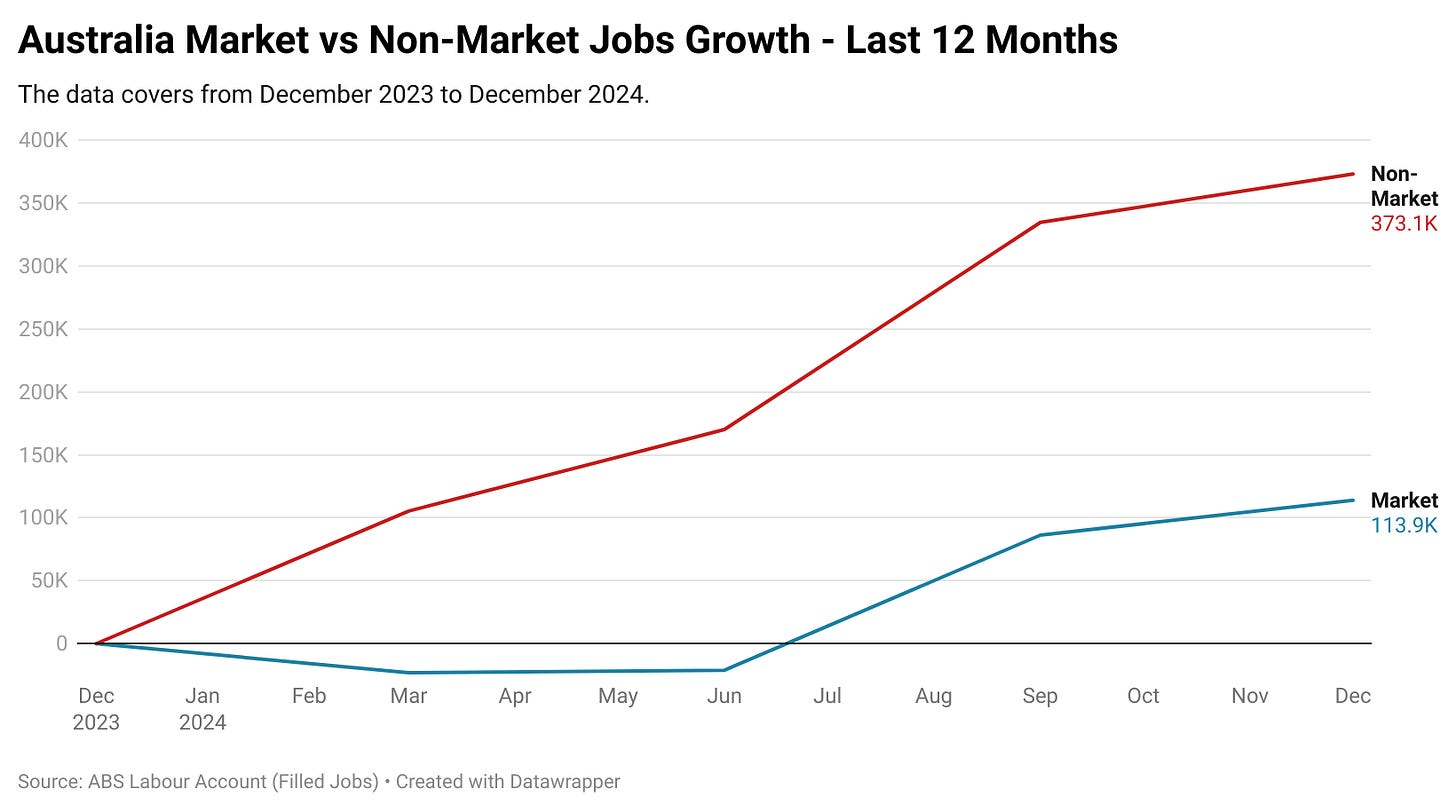

That being said, when looking at the finer details of the labour market things are not going ideally, despite the big headline job creation numbers. According to the ABS Labour Account, of the 486,900 jobs created over the last 12 months almost 70% were in non-market roles, aka in generally government funded industries. This is something that I have covered in detail in the past here at BurnoutEconomics.com.

If non-market jobs growth was to slow dramatically without a similarly large reduction in labour force growth, the economy could be left with rising unemployment in relatively short order.

I’ve come to a point where I don’t put too much stock in a single print of the ABS employment data. But when combined with the outsized rise in unemployment seen by the Roy Morgan employment data and the decline in job vacancies seen in data from Seek, Indeed and the ABS, one has to at least consider the possibility that the labour market may deteriorate to a greater degree than forecasted.

For a long time now the luck of the nation’s labour market has persisted, albeit heavily supported by taxpayer funded employment. To what degree that luck will hold as a federal election impacts spending plans and priorities, and a change of government in Queensland brings a push to cut public sector jobs, we’ll just have to wait and see.

— If you would like to help support my work by making a one off contribution that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my paid Substack

Thanks for your perspectives. I have been reading your views for sometime and just signed up as a $240 member. I am a 58 year old novice with no formal education in economics and finances, which I think is how the government wants it. But I am an avid learner and spend time diving into the key measures to better understand what politicians tell us vs the actual context. I posted the other day on my FB page and a Labor troll took aim at me. So I dug a little deeper into him. On the Labor socials, they are spruiking 4% unemployment, 2.4% inflation, and 3.5% real wage growth. I questioned their real wage growth number as my (rudimentary) understanding of real wage growth is nominal wage growth (3.2%) less inflation (2.4%) = real wage growth (i.e. 0.8%). But even that is not close to the 'pub test.' The average Aussie is feeling inflation of somewhere between 12-25% in my opinion. Energy prices, fuel went up by 60-100% and never returned, education is up 12%, rates have skyrocketted, food prices are off the scale, building supplies, and general cost of living is not 2.4%. So when you factor in, say, 15%, then the effect is more like -11.8% real wage growth. Perhaps I am missing something, but as someone that has tracked every cent I have spent since 2009, my own household costs have increased 14% year on year. My salary certainly has not gone up by 14%, and I dare say most are in this boat. Also, and I think this is a big issue, which your article calls out, job growth is from the public sector. 1 in 5 Australians are employed in some way by the government. In a working population of 17-ish million, that's extraordinary. Of course NDIS is funding most of it and now costs ~$40 billion a year, exceeding Medicare. Where does this all go? I'm not sure, but as someone with close to 40,000 on my social page, I can safely say a lot of Australians are deeply concerned with where our country is going.