Demographic Fundamentals For Chinese Housing Demand To Plummet

100m fewer 'Prime Age' Chinese (25-54) by 2030 vs 2017 peak

I am pleased to announce that I am opening up to commissions for articles and research reports. If you would like to commission me to put together something for your organization, just drop me an email at avidcom@substack.com and we can discuss it in greater detail.

Now on with the article!

Since peaking in 2021, the large falls in Chinese property demand have made headlines around the world. Collapsing mega developers such as Evergrande and Country Garden have become all but household names, as one of the world’s largest industries in the world attempts to come to terms with the new paradigm.

Its worth exploring what this enormous reduction in demand has been driven by and what the outlook looks like for the future based on the data we do have. But despite news of China’s demographic decline, so far the reduction in demand has generally been driven by investors buying far fewer properties. According to a (U.S) National Bureau Of Economic Research paper by Kenneth Rogoff and Yuanchen Yang, in 2018, 87% of Chinese purchasing a new home already owned one or more dwellings.

In addition to the deteriorating demand side driven by investors, it was recently reported that ANZ Bank estimated that the amount of unsold residential property in China had hit 3 billion square metres at the end of 2023. Based on the average urban Chinese home size, this equates to roughly 30 million new homes.

While perspectives vary significantly on how many empty newly constructed homes there are, estimates at the low end put it at around 2 years of supply based on the current level of sales activity.

But when it comes to main event, China’s demographically driven falls in demand for property, we have only just begun to scratch the surface.

Demographic Driven Decline

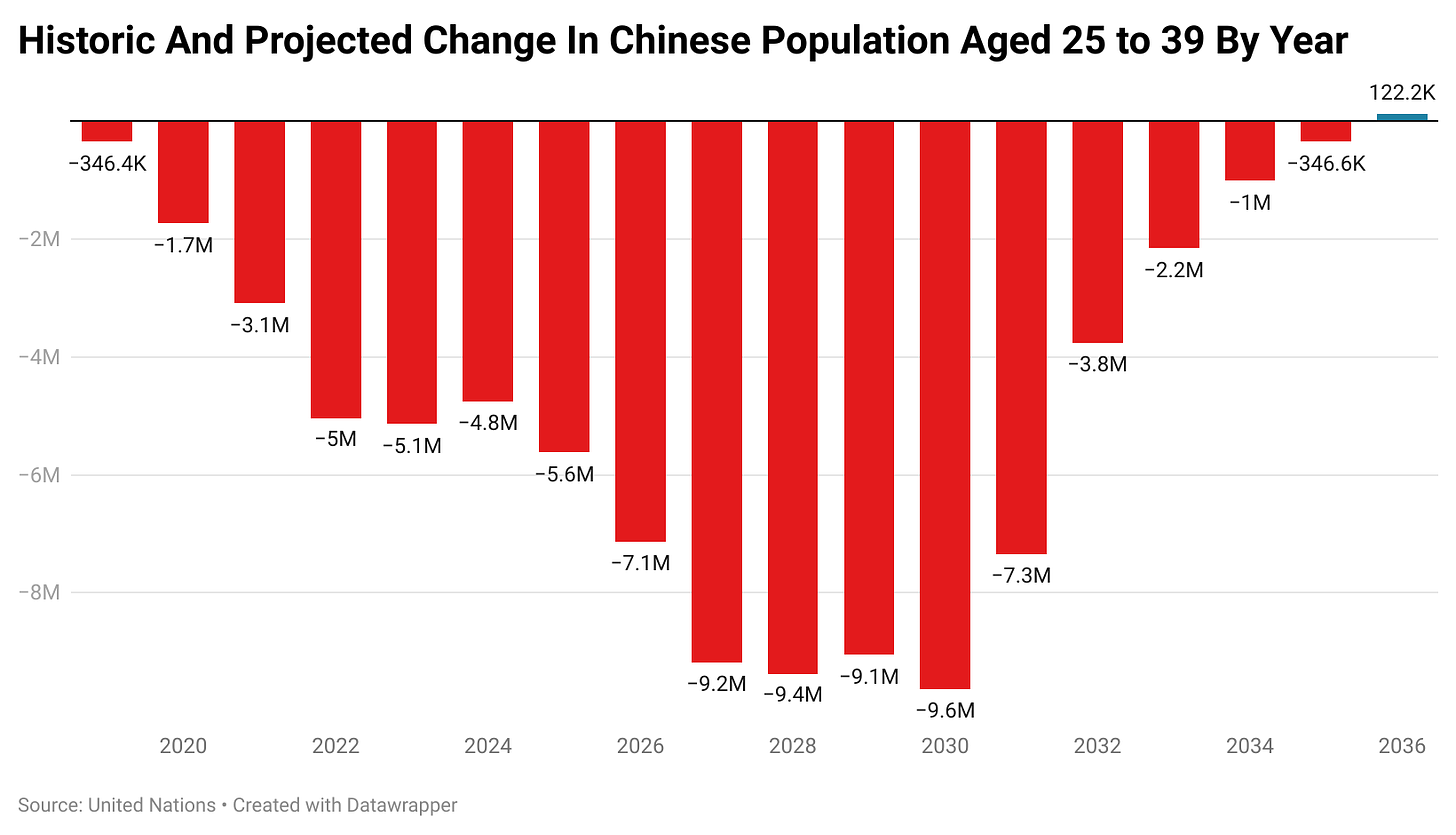

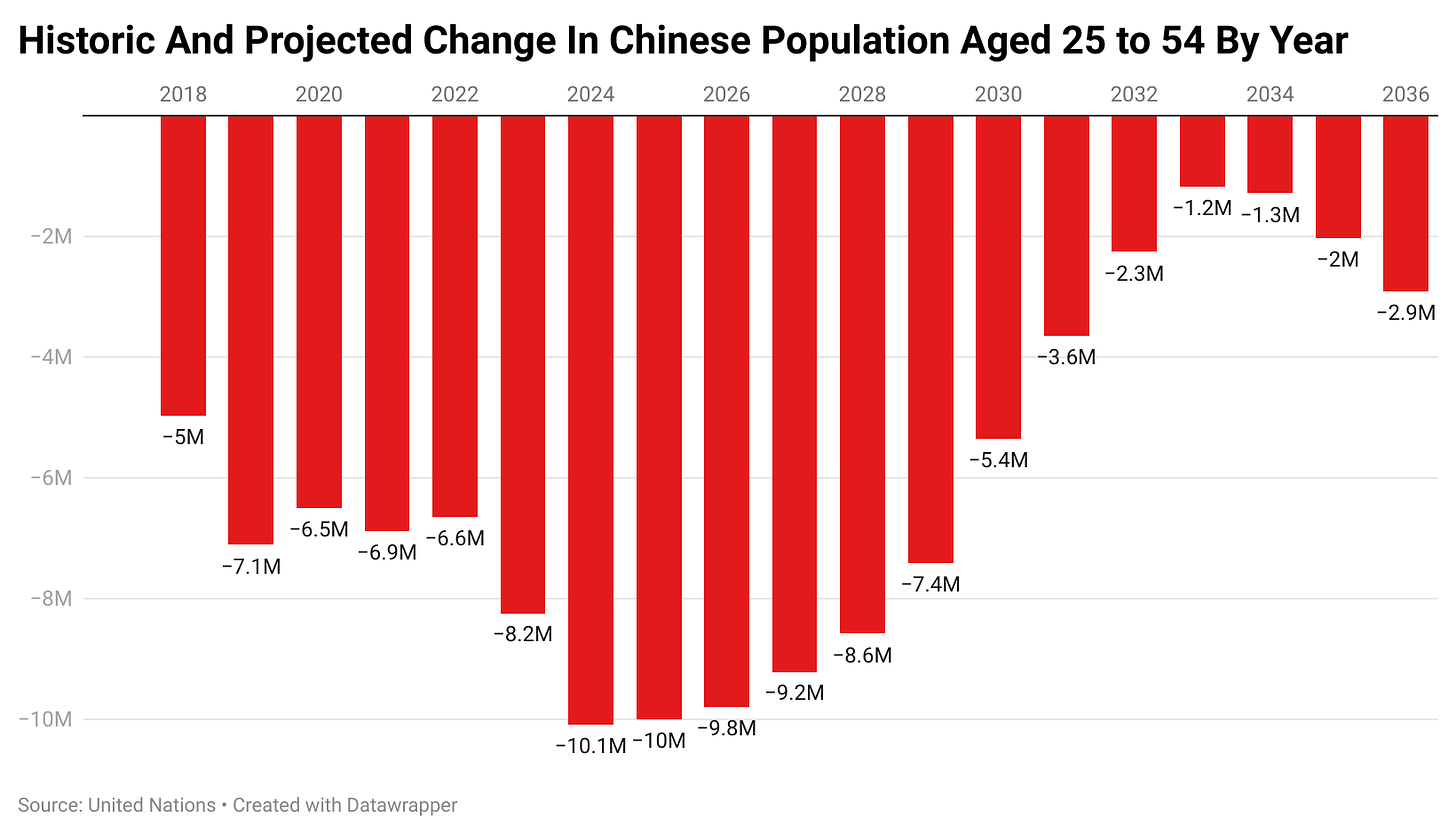

The demographically driven decline in demand for Chinese property can be viewed through several different lens, but for today we’ll be focusing on two, the number of Chinese aged 25 to 39 and aged 25 to 54.

The 25 to 39 demographic represents households looking to buy a home for the first time and become a net addition to overall home ownership. The 25 to 54 demographic is the age demographic likely to be transacting on homes more broadly and represents the overwhelming majority of overall housing turnover.

While both assessed demographics are on a swiftly deteriorating down trend, there are differences in the timing of the severity of the decline and when the pace of the decline begins to slow dramatically.

The Prime First Home Buyer Age Demographic

The population of the 25 to 39 demographic peaked in 2018, at a shade under 328 million people. By 2026, that number will drop from by 32.8 million and by 2030, it would have fallen by over 70 million.

As of the end of 2023, the size of this demographic has been reduced by 15.3 million, this represents 4.9% of its peak size. While the aggregate demand for housing based on the average household size (2.62 persons) has decreased by 5.86 million homes as of 2023, this represents the tip of a much larger iceberg. By 2030, demand from this demographic will be reduced by 26.7 million homes.

Falls in the size of this demographic rapidly accelerated to over 5 million people annually in 2022. The falls will accelerate further to over 7.1 million in 2026 and then over 9 million per year until 2031.

The Broader Home Buying Demographic

Meanwhile in the broader 25 to 54 age demographic, things have been deteriorating quite a bit faster. Since peaking in 2017, this age group has already shed 40.3 million members, with more than half those exiting the demographic before demand for property peaked in 2021.

But it get’s significantly worse starting now. In 2024, it is estimated that this demographic will lose 10 million people during this calendar year. By the end of 2027, this group will have shed the best part of 80 million people since peaking a decade earlier.

By 2030, this demographic would have shed over 100 million people and based on the average household size reduced demand for housing turnover by 38.5 million homes.

The Elephant In The Room

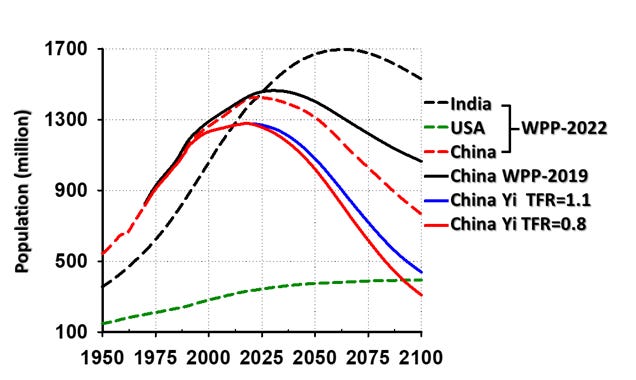

Its important to note that this analysis is based on Chinese government population statistics being taken at face value. Its entirely possible that the demographic cliff that will impact Chinese property and broader consumer demand is significantly greater than these graphs and data would suggest.

According to an analysis by author and demographer Yi Fuxian, China’s population, particularly in younger demographics is significantly smaller than the official statistics claim. According to Yi’s analysis, in 2023 the number of Chinese was 130 million fewer than what headline statistics claim.

The graphic below is from Yi’s Twitter and projects that there are tens of millions fewer people in their teens and twenty’s than what is officially claimed from China’s government statistics agency.

If Yi’s conclusions are correct and the gap is driven almost entirely by fewer young people than anticipated, then the relative impact of the falls seen in the graphs above are likely to be far greater on the property market and the broader consumer economy.

The Outlook

Between the long lasting and hard hitting deterioration in property buying demographics and the fact that the overwhelming majority of property was being bought by investors prior to the pandemic, its challenging to quantify exactly how far the fundamental level of Chinese property demand sits below the current state of activity.

Property sales are already down up to 50% by some metrics and continue to deteriorate as time passes. Even if we were to throw out a wild guess that where we sit now in terms of sales is roughly the markets underlying equilibrium point, it would mean that demand for multiple key commodities would take major hits.

The property construction sector consumes 35% of all steel used in China and to have more than half that demand eventually disappear, would be hugely significant for steel making commodities such as iron ore and metallurgical coal.

For now, the Chinese government is attempting to maintain its steel and finished materials production capacity by increasing levels of infrastructure investment.

But as the level of previous debts needing to be rolled over balloons and the gap left by the property sector’s decline becomes larger and larger, eventually the scope to successfully continue this strategy will run out.

At that point China’s trade partners who bet their future on the status quo continuing will need to confront some hard realities, as the proclaimed century of strong Chinese demand for their commodities draws to a close quite a bit earlier than they were expecting.

— If you would like to help support my work by making a one off contribution that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my paid Substack

I am currently compiling data on Chinese local government bond issuance and local government land sales going back over a decade for an upcoming article. If you would like this article delivered to your inbox you could subscribe right here.

Not sure if this has come across your feed.

https://overcast.fm/+yOwBU8TXk

James Aitken, ex Oz investor currently living in the UK, interesting take on China.

Thank you for sharing your thoughts. Martin

If this is true, I wonder why iron ore prices have not fallen. I guess there's a few explanations: 1) lag 2) other construction 3) stockpiling (for war, inflation, or market manipulation)