Charted Territory - The Top 10 Charts Of The Week

This week we cover everything from rising U.S wages growth to the recession in global trade volumes

Welcome to this week’s instalment of Charted Territory.

If you have any suggestions for charts to include next week or feedback on this format, please share your view in the comments below.

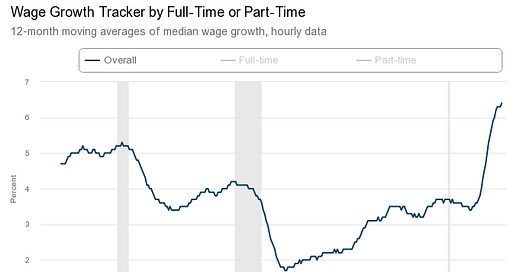

U.S Wages Growth Continues To Accelerate

According to data from the Atlanta branch of the U.S Federal Reserve, U.S wage growth pressures have continued to accelerate, hitting 6.4% in March.

While other wage growth indicators are telling somewhat different stories, the Atlanta Fed’s data would certainly be a cause for concern for Jerome Powell and the rest of the FOMC, who would very much like to see wage growth pressures moderate toward a level consistent with the Fed’s 2% inflation target.

Back in December, Powell shared his view that wages growth of around 3.5% would be compatible with the Fed’s 2% inflation target. As things currently sit today we are quite a ways from a credible path back to 3.5% wages growth.

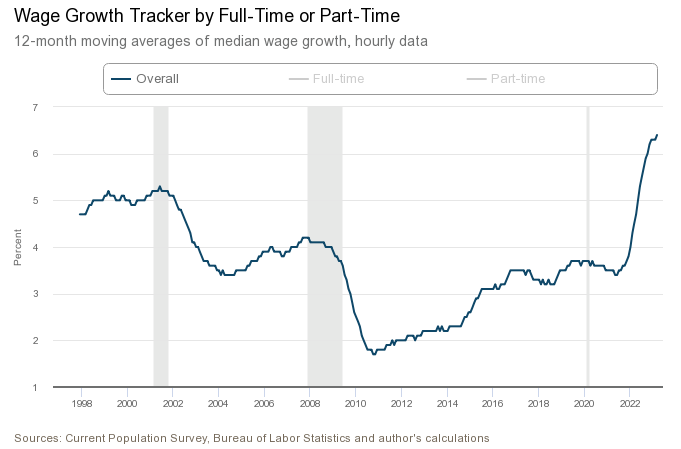

A Potentially Concerning Sign Of Further U.S Rental Inflation

This chart from Mikael Sarwe paints a concerning picture of the future path of U.S rents. While Zillow and Apartment List have both seen rental price growth moderate significantly in recent months, the U.S Census Bureau’s data on asking rents for vacant units is providing a very different perspective.

In Q1 the Census Bureau saw asking rents jump significantly, raising some potentially major questions about whether the Fed will be correct in its view that rental inflation is set to moderate back to historic norms.

While this is just one indicator, its none the less a factor worth keeping an eye on, as it could underpin a sustained round of further inflation.

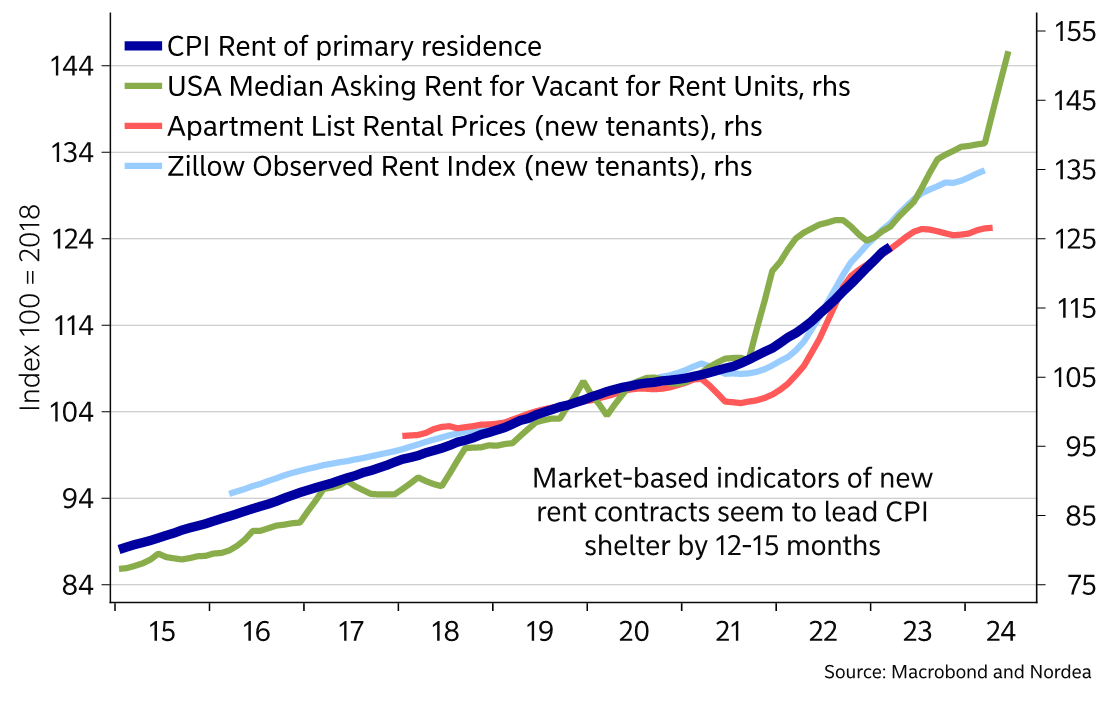

Global Container Throughput Index Points To Recession In Global Trade

This chart from Callum Thomas paints quite a concerning picture for global trade, echoing the large falls in container volumes seen in various U.S rail and sea based container statistics.

A significant driver of this is retailers and wholesalers looking to reduce their inventories after most over ordered in the expectation that pandemic driven demand would continue.

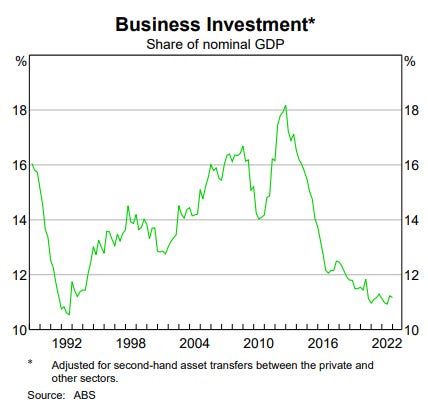

Australian Business Investment Remains At Recessionary Levels

Despite all manner of support provided by easy monetary policy, government guaranteed loans and hundreds of billions of dollars of stimulus, Australian business investment as a percentage of GDP is stuck at roughly the same level as the lows recorded following the 1990-1991 recession.

Considering credit is being tightened and the RBA forecasts the economy to have a recession in per capita terms, business investment may have further to fall.

Copper Production May Undermine Green Agenda

With the average time taken between a new copper mine’s conceptual stage and actual production now reaching over a decade, there are increasingly concerns that the demands placed on the resources sector by the push toward net zero may not be adequately met.

Amidst a backdrop of less and less desirable sites for new mines, increased costs and geopolitical uncertainty, large copper producers are generally going through every new mine proposal with a fine tooth comb and keen eye for risk management.

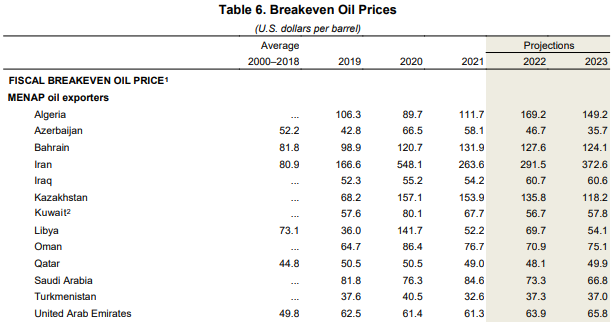

Oil Price Required For Fiscal Breakeven For Various Oil Exporters

With oil prices recently hitting their lowest level since December 2021, this chart from the IMF on what oil price is required for the government budgets of various oil exporters to break even is an interesting one to explore.

Despite only being a single data point, it provides some degree of insight into where the pain point is for various oil producing nations and when they could decide that further intervention in oil markets is required.

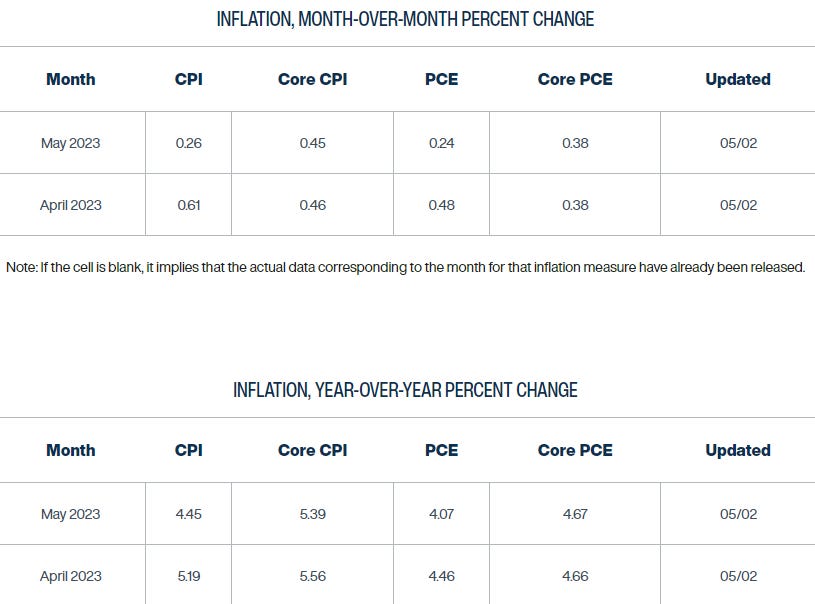

Cleveland Fed Inflation Nowcast Points To Sticky Inflation

In recent times the Cleveland Fed’s Inflation Nowcast predictions have been relatively good. In a few instances the tool has been bang on with its forecast and has generally been relatively ballpark.

The continued strength in the month on month figures would be of particular note, as the Fed attempts to find a credible path back to its 2% target.

Breakeven Price For Iron Ore Producers

Amidst a backdrop of an average negative margins for Chinese steel producers on their produce, this chart is an interesting one. Iron ore prices are well above the breakeven point for producers in the 90th percentile.

There could be significant further downside ahead if the Chinese steel sector fails to sufficiently fire, with major implications for the government budgets and economic fortunes of Brazil and Australia in particular.

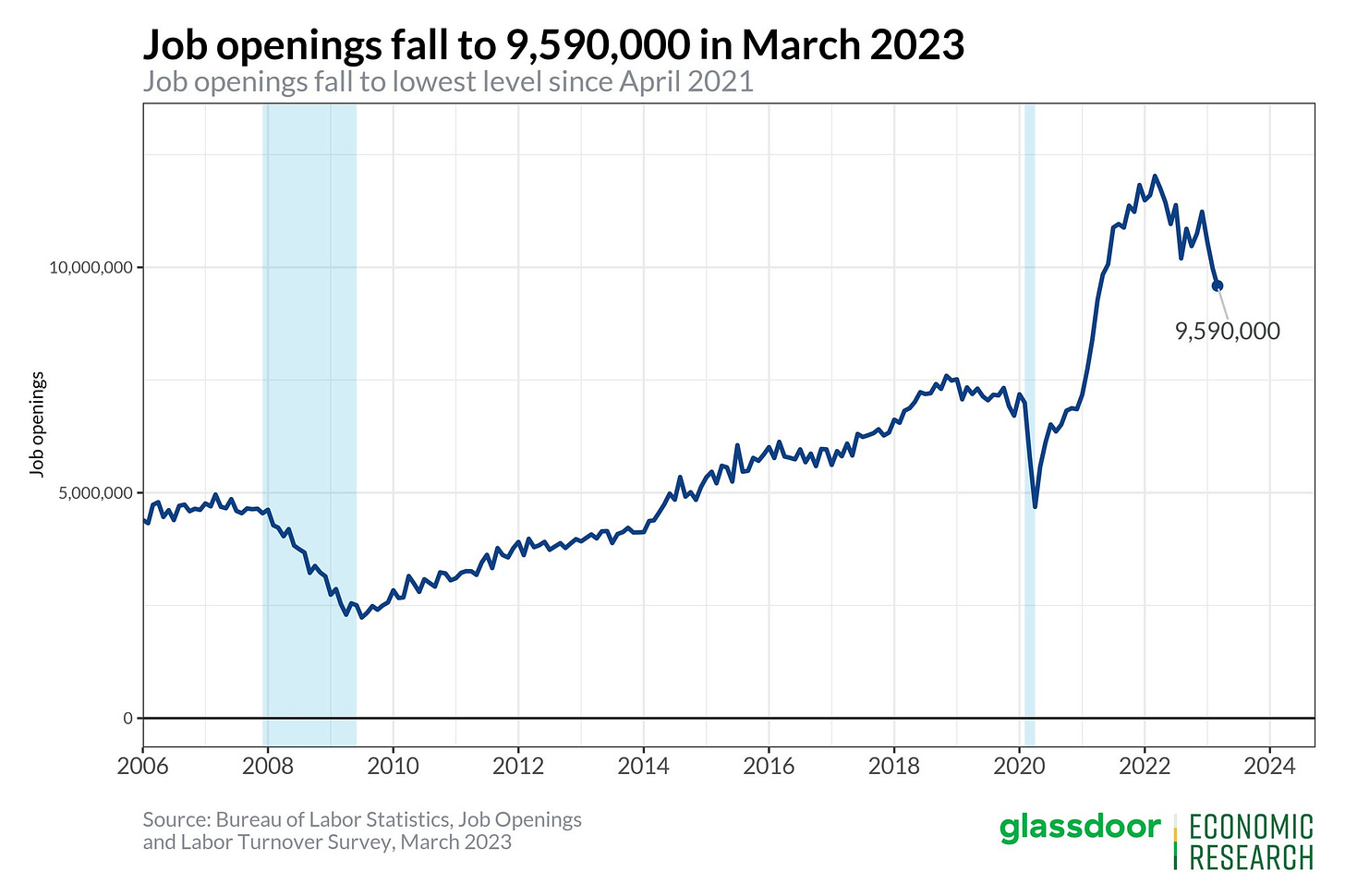

U.S Job Opening’s See Big Falls, But Remain Elevated Compared With Historical Norms

Recent months have seen large falls in the Bureau of Labor Statistics JOLTS Job Openings Index, with openings down by 1.42 million over the last 3 months.

But despite these big headline falls, the index is a long way away from indicating a level of weakness consistent with the U.S labour market not producing enough jobs to keep up with labour force growth.

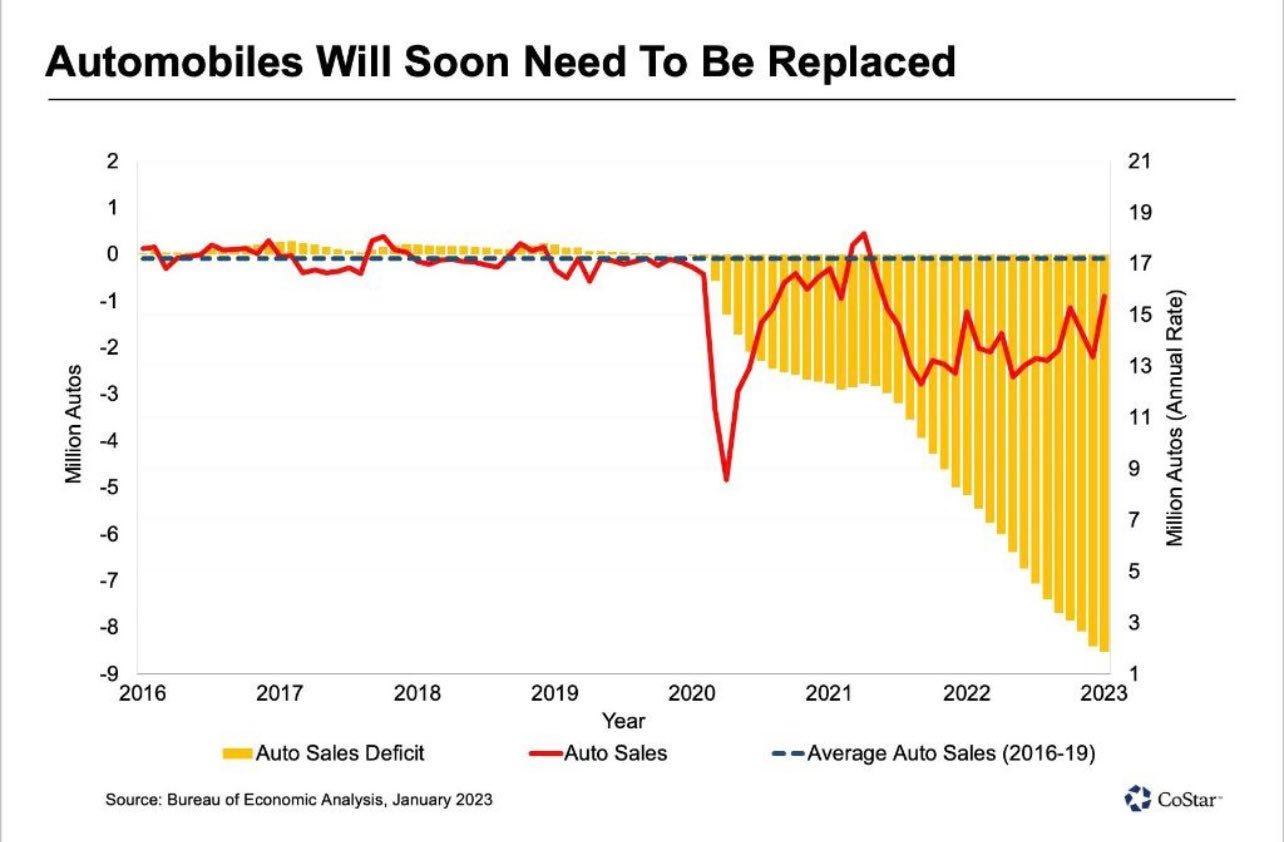

Weaker Than Trend U.S Auto Sales And Aging Vehicle Fleet

According to a recent report from the U.S Bureau Of Economic Analysis, there is a deficit of around 8.5 million vehicles in the United States. This is based on a metric that takes pre-Covid auto sales then subtracts auto sales seen since the pandemic began.

This has a few interesting implications, most notably Americans keeping cars in service for significantly longer and used cars potentially retaining a higher degree of value than they otherwise would have historically.

Thank you for your readership and have a great weekend.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

If you would like to support my work on an ongoing basis, you can do so here via Patreon or via Paypal here