Big Tech - An Inflationary Force?

The long held relationship between big tech and deflation called into question.

In the world of economics and finance there are few ideas that don’t prompt rigorous and at times furious debate. But one that is generally taken for granted by economists and analysts from across the spectrum of the different approaches, is the idea that the tech sector is a deflationary force on the broader economy.

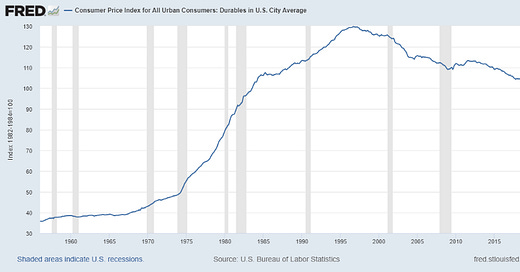

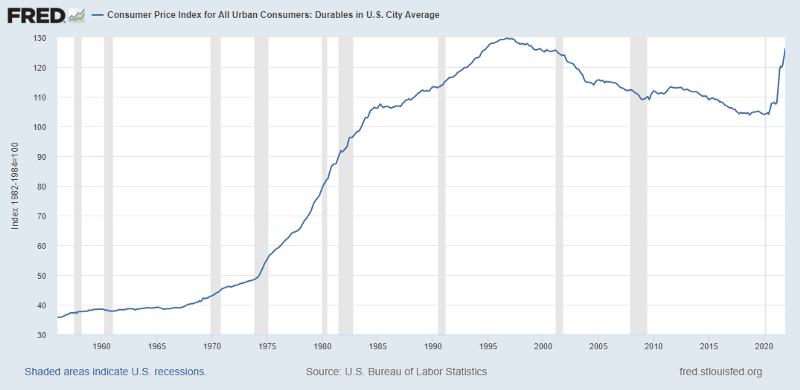

One of the best illustrations of this deflationary force in consumer prices is the U.S CPI’s consumer durables sub-index. In hedonically adjusted terms (the Bureau of Labor Statistics adjusts for the relative quality of a product, for example the addition of airbags to cars etc.) durable goods prices peaked way back in September 1996.

Despite a 21.3% increase in the price of durable goods in the past 18 months, they remain 2.7% below their 1996 peak.

While the ongoing rise of automation and further advances in technology is likely to continue to prove to be a deflationary force in a vacuum, more broadly the tech sector may no longer be the broad based driver of deflation it once was.

As big tech reaches what is basically a saturation point in terms of market share, they are able to use this leverage in order to impose price increases that are far greater than headline inflation in order to keep growing their revenue base.

Amazon — Earnings Disappointment Prompts Prime Price Hike

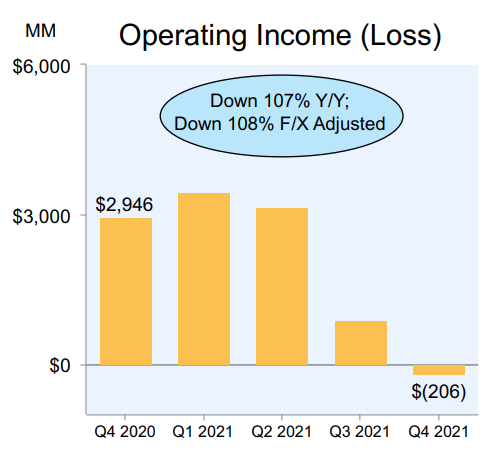

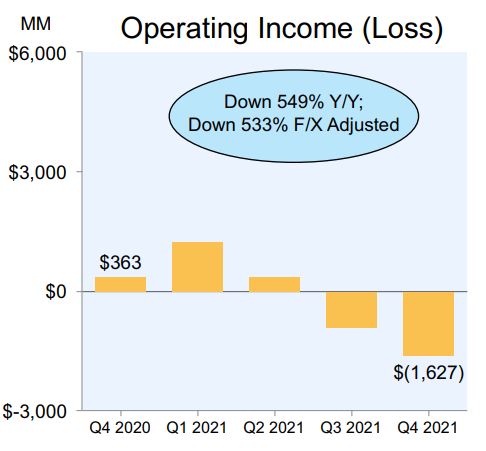

Despite Amazon’s share’s rocketing on the release of its recent earnings report, operating income from its core e-commerce operations performed poorly.

In the U.S, the operating income for its e-commerce business was a loss of $206 million. The broader trend is also not favourable for its American e-commerce earnings, with operating profits peaking in Q1 2021.

Meanwhile in Amazon’s international e-commerce business, the company recorded an operating loss of $1.63 billion for Q4 2021. Operating income internationally is also in a downtrend after also peaking in Q1 2021.

As Amazon’s e-commerce business continues to struggle with declining earnings, the company has hit upon a simple yet likely effective move to underpin its online retail driven revenue.

A 16% price hike in the cost of its Amazon Prime service for its 148.6 million American subscribers.

Based on an average increase $20 per year (increase is $24 per year for users who pay monthly) this would generate around $2.97 billion a year in additional revenue. Considering that this additional revenue would come at a relatively minimal cost, it would make Amazon’s U.S based e-commerce business highly profitable.

But this change raises a challenging and perhaps uncomfortable question. If Amazon and companies like it are going to raise prices to not only account for the rising cost of doing business but also to maintain high levels of earnings growth, could elements of big tech increasingly act as an inflationary force?

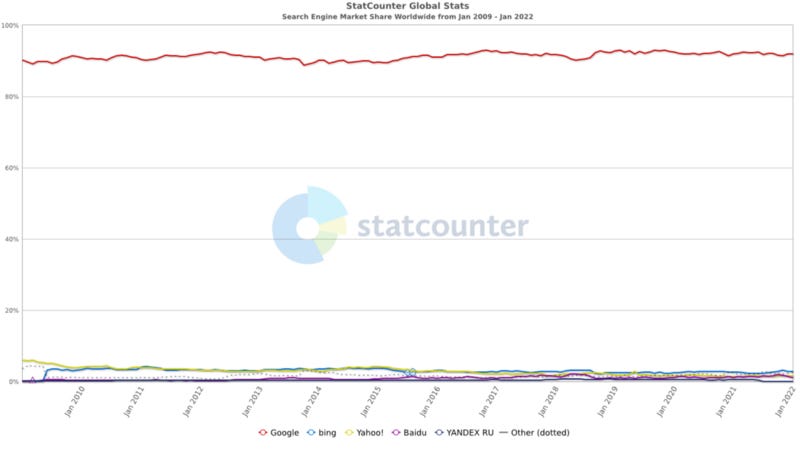

Google — The Search Engine Monopoly

As the gateway for 92% of internet searches, Google or Alphabet as its parent company is otherwise known, possesses one of the greatest business monopoly’s in the history of the world.

While rivals have consistently tried to take a slice of the search engine pie over the years, Google’s market share has remained relatively stable for over a decade.

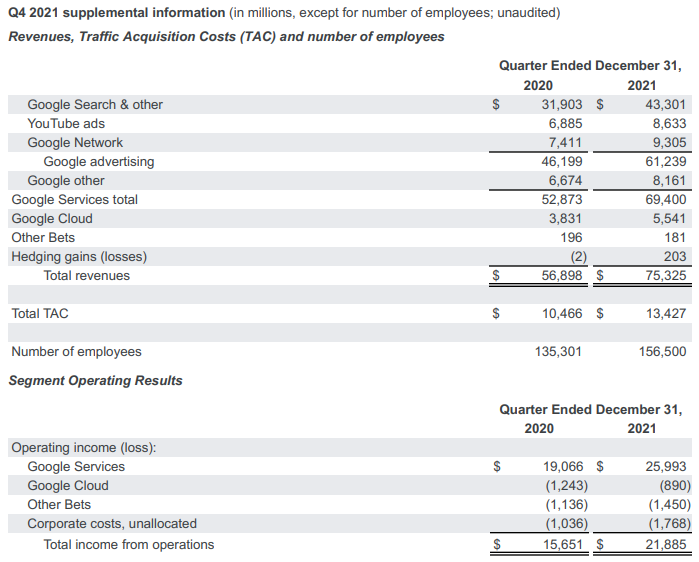

Unsurprisingly Google has taken advantage of the situation. According to industry journal Mi3, Australian ad agencies have seen the cost of Facebook and Google Search advertising rise by almost 50% during the 2021 financial year.

In the U.S, independent marketing firm Tinuiti which manages a $2 billion a year advertising spend has seen a similar trend, with Google’s CPCs (Cost per click) rising by 36% and YouTube’s cost per thousand views rising by 35% in the year to June 2021.

These increases in advertising costs, roughly mirror increases to Alphabet’s earnings with total revenues rising by 32.3%.

While there is no denying that Alphabet is a company that enjoys solid management and strong demand, its earnings growth is heavily underpinned by rising prices for its core products.

Going forward its entirely possible that Alphabet may be able to continue to squeeze business owners for ever greater prices for advertising costs considering that they are effectively a monopoly business in some cases.

But as costs rise for businesses, those costs will need to be passed onto consumers. From the local small businesses to nationwide conglomerates, prices will have to rise to some degree for all businesses, with some being much harder hit than others.

Big Tech Earning Growth Built On Rising Prices

The days of greater productivity improvements and expanding product ranges underpinning the earnings growth of big tech is arguably at a pause, replaced by leveraging market share into price rises that are double or even more than quadruple the rate of the U.S CPI.

In the realm of industry the ongoing march of automation and technological advancement will continue to underpin deflationary forces. With everything from the proliferation of backyard 3D printers to automated football field sized factories continuing to act as a means to reduce costs for consumers.

But in the world of big tech where market share has already reached a relative saturation point, and continued strong earnings growth is demanded by shareholders, some of these companies such as Amazon and Google may end up acting as a significant driver of inflation as they attempt to continue their run of robust earnings growth.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Thank you for your readership.

Great read, thank you 👌