Aussie Housing Prices On Course For the Biggest Falls in 40 Years - Predictions Vs the Data

The trend is not the Aussie housing markets friend

Disclaimer: This is not financial advice and should not be considered as such. If you require personalized financial advice, please seek the services of a relevant professional.

In recent weeks predictions on the course of Australian housing prices have been coming in thick and fast, from all quarters, with even the Reserve Bank Governor Philip Lowe throwing his hat into the ring, predicting a 10% fall.

The predictions generally range between falls of 10-25%, with some analysts adding qualifiers that if rates stay higher for longer, price falls could be significantly larger.

According to housing price data provider Corelogic, price falls greater than 11% at a national level would be the largest in the 41 year history of their data series.

In order to put these predictions into perspective, we’ll be looking first at what has already transpired within the Australian housing market and then extrapolate when various downside targets will be hit based on current trends.

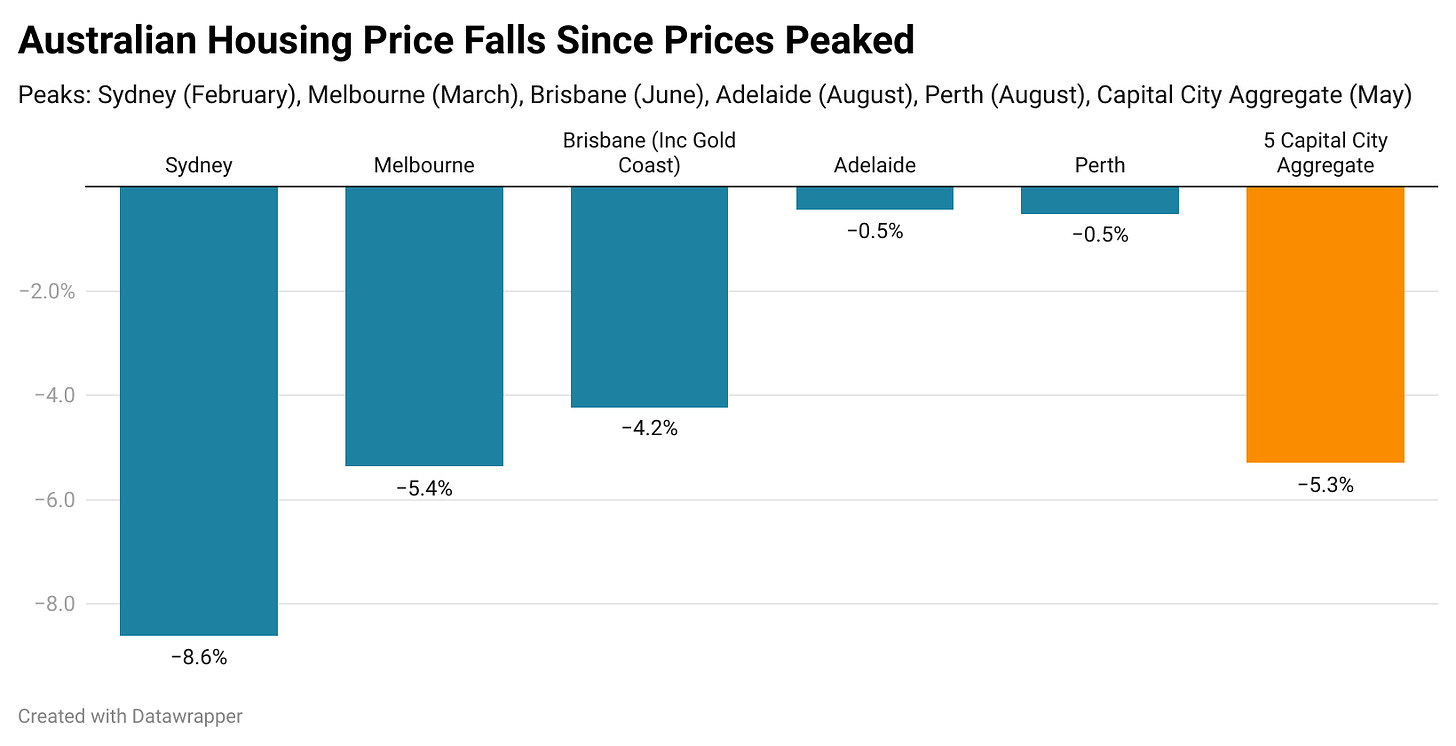

Outcomes within the various capital city markets have been quite disparate, with Sydney leading the rest of the pack down starting in early February. While other markets showed a greater degree of resilience, one by one they have joined the price falls over the following months.

As price falls became more widespread, so too did the rate of decline for the broader market increase. With the capital city aggregate figure falling by 1.6% in August.

This figure has continued to accelerate with each passing month, rising from falls of just 0.35% nationally back in June.

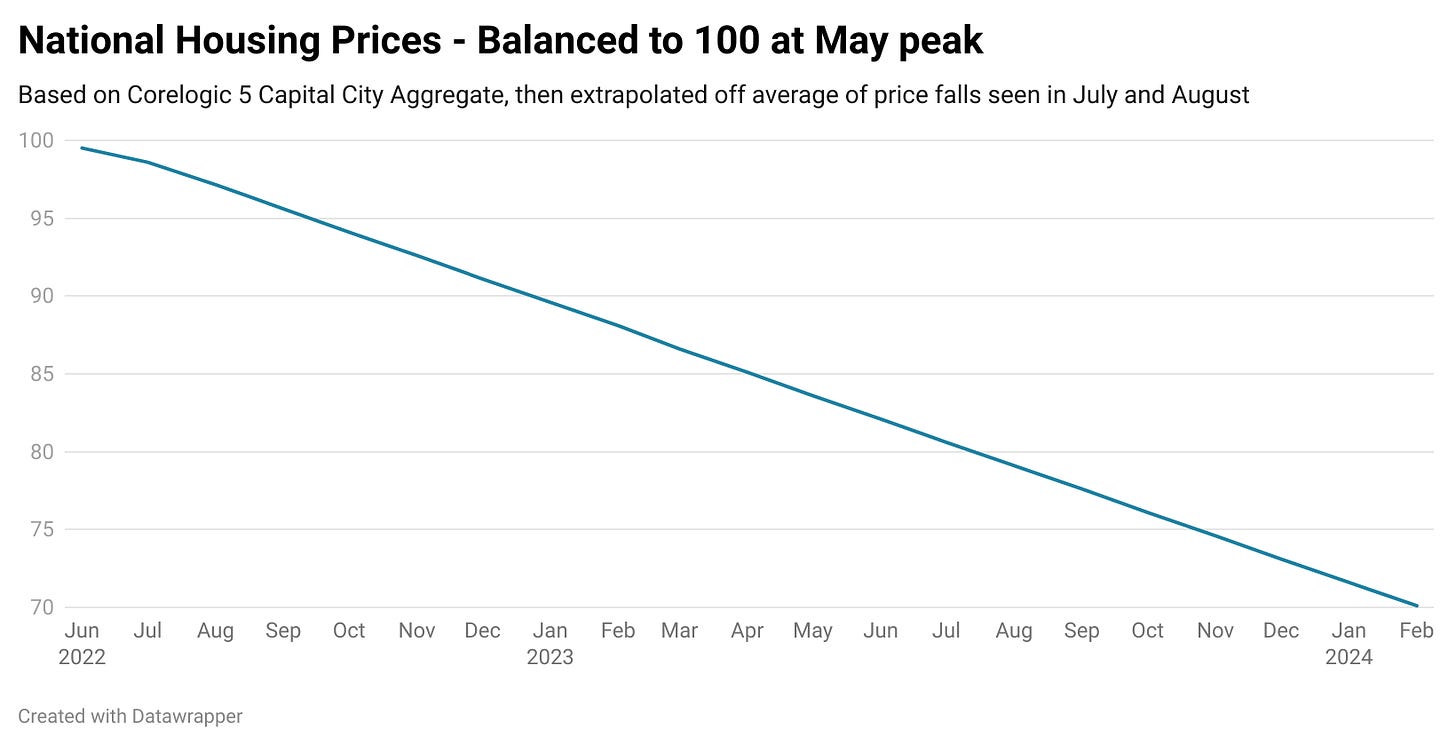

For the purposes of today’s projections, we’ll be basing them on a conservative rate of price falls, the average over the last two completed months, July and August. This comes in at monthly price falls of 2.65 Corelogic index points (1.54% of July prices).

Based on this admittedly rather basic metric, the analysts price falls targets would be hit in the following months:

10% Down - January 2023 (Predicted by: RBA Governor Philip Lowe)

15% Down - May 2023 (Predicted by: Coolabah Capital [Chris Joye], Commonwealth Bank,

20% Down - July 2023 (Predicted by: National Australia Bank, ANZ, Westpac [18%])

25% Down - November 2023 (Predicted by: Coolabah Capital [Chris Joye] - Downside scenario, CIS economist Peter Tulip)

30% Down - February 2024

Considering that Australian inflation is expected to peak in Q4 and that data won’t be released until the end of January, its highly unlikely that looser monetary policy will be riding to the rescue any time soon, bar some sort of crisis.

While the RBA may be given pause in 2023, even the most optimistic inflation forecasts suggest inflation will remain above 3% until the end of the 2023 at the earliest.

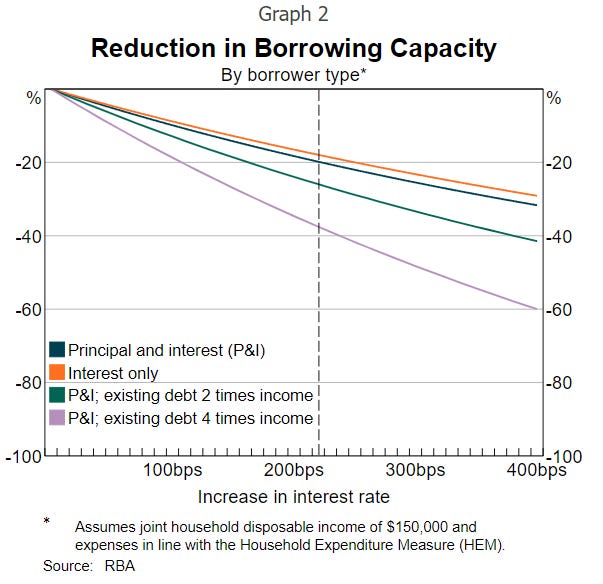

Given how much borrowing capacity is being curtailed rapidly, bar some sort of crisis or intervention by APRA, or the federal government, can price falls be arrested before dropping 15%?

This is very much an open question, but the evidence we do have has left our magic 8 ball reading ‘Outlook not so good, ask again later’.

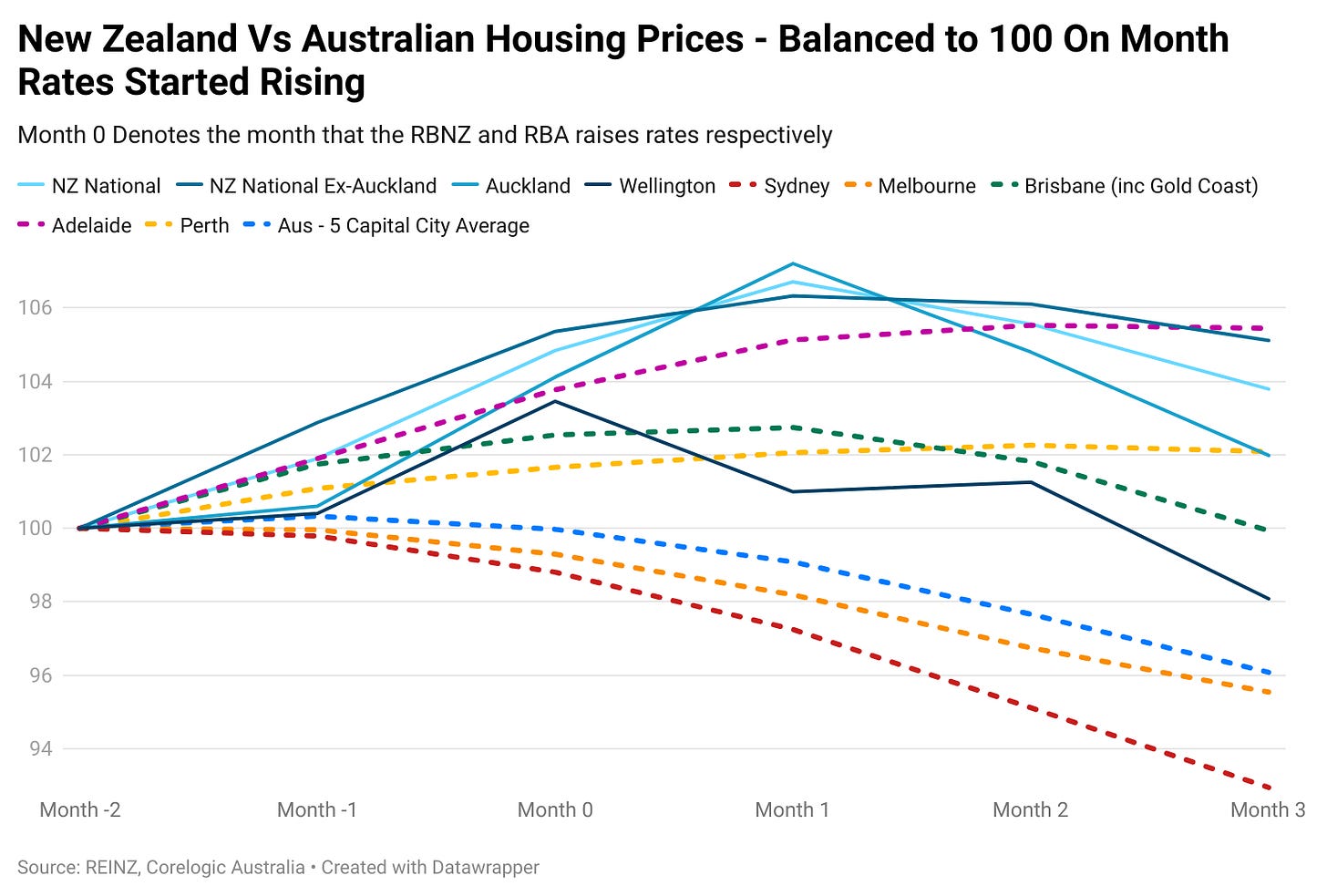

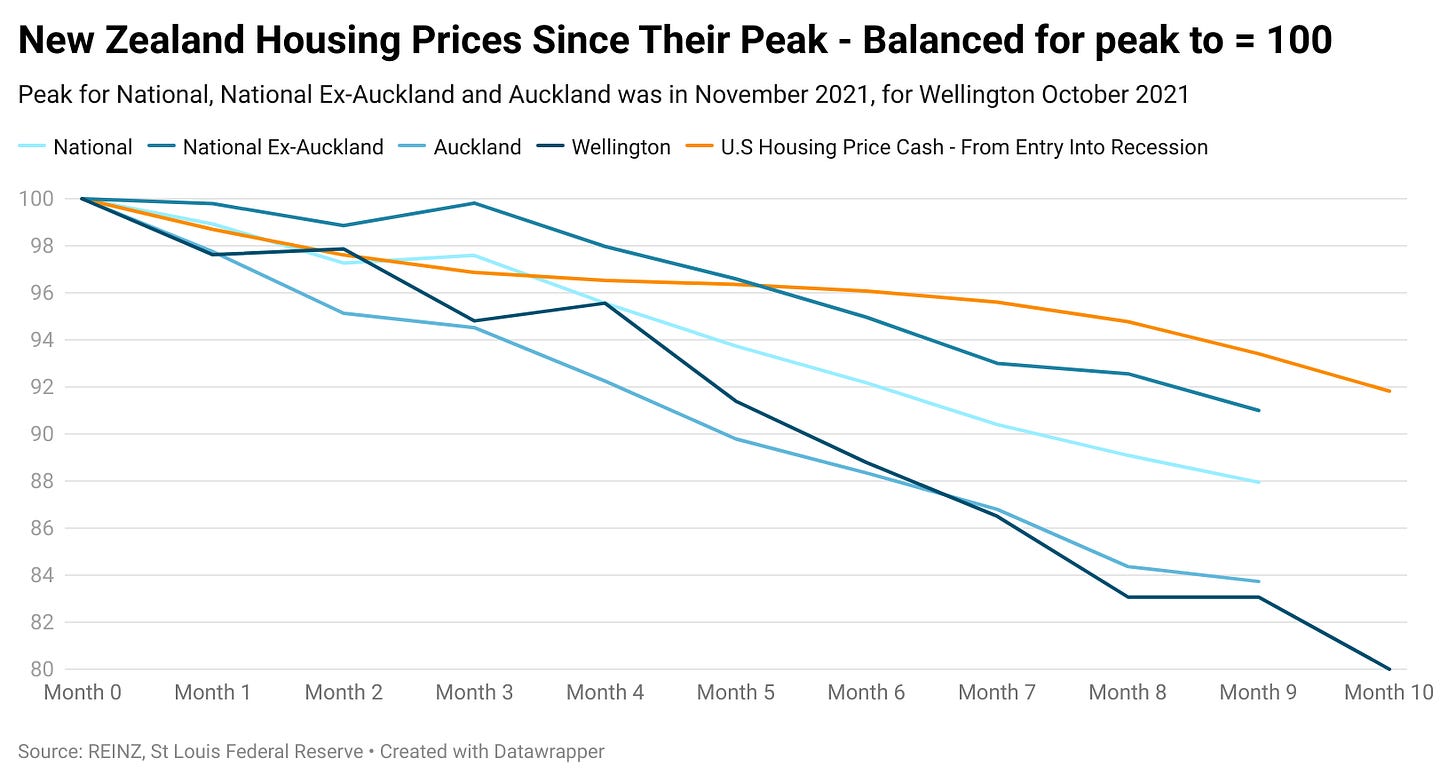

In New Zealand, housing prices at a national level have already fallen more than 12% since their peak back in November and prices continue to fall rapidly with no sign of slowing.

At this point some of you might be wondering why I am talking about New Zealand? In short it is the closest analgous market and a bellwether for housing markets globally.

Its usually now when someone points out the differences between New Zealand and Australia, like the existence of negative gearing or the capital gains tax discount, concluding that Australia will fare better than its counterpart across the Tasman.

Except it isn’t. Australian housing prices are falling significantly more rapidly than they did in New Zealand at the same point in their rate rise cycle.

In New Zealand’s biggest city, Auckland, prices are down 16.3% from their peak and in Wellington they have fallen by 20%.

To put these falls into perspective, nine months into the U.S housing crash during the global financial crisis recession, prices nationally were down just 6.6%.

Australia too is seeing its housing market fall more swiftly than the U.S during that period.

Whether Australia can avoid New Zealand’s fate is a highly debated issue. But unless the RBA breaks with the Federal Reserve and the long list of developed world central banks that are following it in aggressively raising interest rates, the support for the market required to arrest price falls will need to come from somewhere else.

In fairness to the analysts predicting price falls at the lower end, many are expecting the RBA to blink and risk weakening the Australian dollar by not raising rates as aggressively as the rest of the world.

That may well end up happening, it would be ultimate modern Australian act, risking importing inflation and further damaging living standards to prop up the housing market.

But if the RBA follows the Reserve Bank of New Zealand and the Bank of Canada, both of whom were also believed to do anything to save their housing markets, but have done the complete opposite, finding a path to price falls remaining contained at low levels becomes far more challenging.

At the rate things are playing out, we may not have to wait too long to see who is ultimately proven correct.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

If you would like to support my work on an ongoing basis, you can do so here via Patreon or via Paypal here

Excellent yet again! 👌

You might need to redo the analysis with rates high until 2025

https://twitter.com/INArteCarloDoss/status/1572536892830404613