Auction Clearance Rates - Sold to Listed - July 2nd 2022

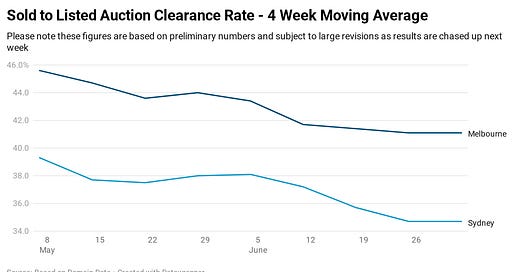

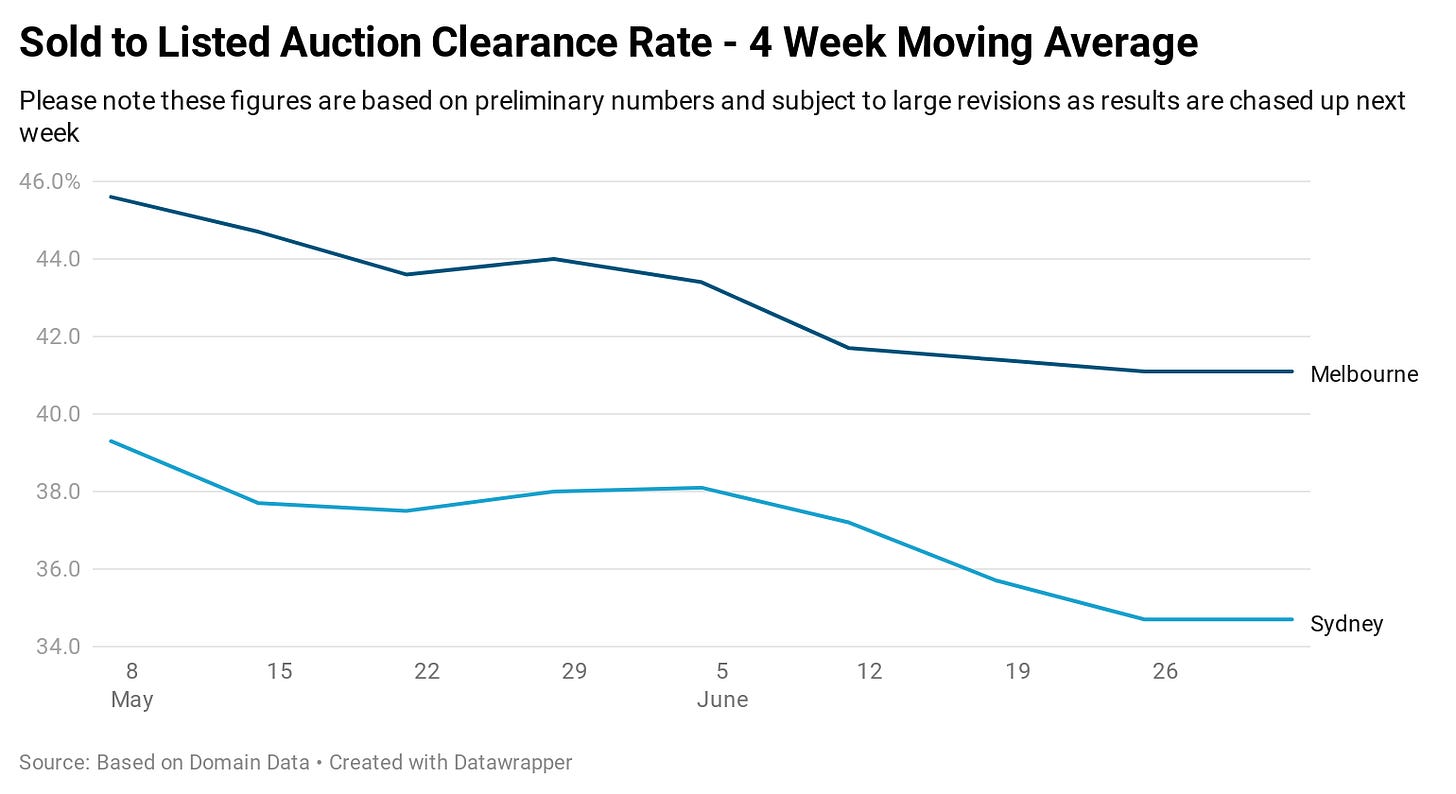

Clearance rates have fallen significantly since rates began to rise in May.

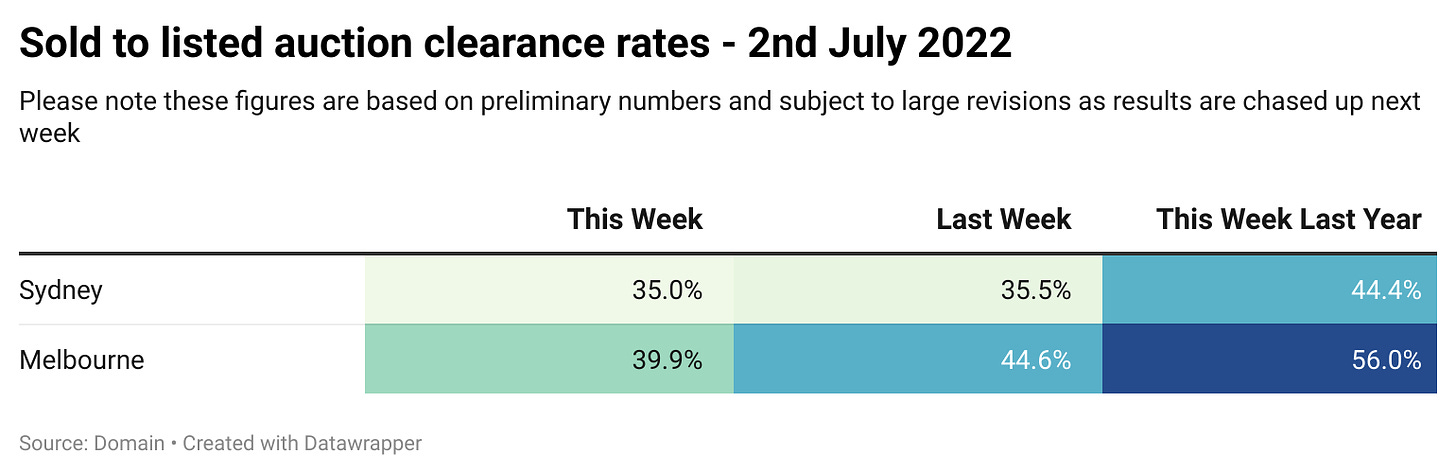

Please note the following is based off preliminary numbers and is subject to significant changes once unreported auctions are chased up.

It should be taken as an extremely rough and preliminary indicator, before other data sources fill in the blank later next week.

For those wanting more accurate data with the missing pieces filled in, that is posted here by the great team at SQM Research on Tuesdays.

Auction Action Summary

Another weekend of poor results for the Sydney and Melbourne markets. This weekend 20% of Sydney’s auctions scheduled were withdrawn and overall auction volumes are 28.8% when compared with this time last year. This is quite notable considering that this weekend last year marked Sydney’s second in 2021’s renewed city wide lockdown.

In Melbourne, its a similar story in terms of a significantly reduced number of properties going under the hammer compared with this time last year, with 37.2% fewer homes scheduled for auction.

Now that we have had a few months worth of data points post the first rise in interest rates, a trend is emerging. On a 4 week moving average basis auction clearance rates are down significantly from where they were prior to the RBA raising rates.

While this is naturally just preliminary data and the SQM figures will provide a more concrete measure of the market next week, its clear that the market is not in strong shape.

For those looking for a bit more on the ground commentary on how auctions are playing out in Sydney, Twitter user ParraPower posts a weekly roundup on the auctions he attends or monitors. His commentary can provide some interesting insight into the current mood of the market.

This weekend I have an article coming out at News.com.au, on how Australia’s housing market is fairing compared with that of New Zealand at the same point in their rate rise cycle. As a bit of a preview here is a copy of a graph analysing how the two markets fared from 2 months before rates rose in their respective markets.

It should also be noted that we are currently in a period where comparisons with last year are somewhat problematic due to the impact of Covid-19 and later lockdowns in Sydney and Melbourne during 2021.

Q&A

Why are these numbers different to those provided by Corelogic or Domain?

This data is based upon the percentage of scheduled auctions that resulted in a sale of the property as of the time of the initial reporting by agents on Saturday evening.

The data from Corelogic and Domain is based upon the number of successful auctions divided by the number of auctions reported by agents and other property industry figures.

— I collect the data and put these roundups together entirely in my own time. If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.