An Era Ends As Russia Invades Ukraine

Amidst the chaos of war there are no easy options left for the West

In the early hours of the morning of the 24th of February local time, Russia’s military launched a large invasion of Ukraine, by land, sea and air, shocking much of the world with the sheer scale of the operation.

Even Odessa on the Black Sea coast hundreds of kilometres from the nearest Russian border was assaulted in a bold but highly risky amphibious assault operation.

According to reports from Acting Chair of the U.S Senate Intelligence Committee, Senator Marco Rubio, Kyiv (Kiev) Airport was assaulted by Russian airborne units.

Meanwhile there is video footage claiming to be of Russian airborne units parachuting down to assault the city of Kharkiv.

Suffice to say that Russia’s assault is well and truly a full scale invasion.

A Watershed Moment One Way Or Another

Amidst all the chaos of war, an era has come to an end today, an era where we could all at least pretend that the so called “rules based international order” actually meant something.

But more than that its a fork in the road for both the global economy and geopolitics.

In the coming days decisions will be made in the halls of power that will heavily influence the coming decade and everything that will come after.

Since the tensions began on the Ukrainian border, U.S President Joe Biden and his closest allies such as British Prime Minister Boris Johnson have promised nothing less than fire and brimstone sanctions on Moscow if they were to invade Ukraine in force.

This included banning Russia from transacting in U.S dollars and British pounds, as well as potentially banning Moscow from the SWIFT system.

Without going into too much detail, the SWIFT system is effectively the back end that underpins bank to bank transactions throughout the world. By banning Russia from the SWIFT system it would be akin to removing them from a sizable proportion of the international financial system.

If this level of sanctions on Russia were to come to pass, it would no doubt prompt a furious response from Moscow and Russia would put together its own economically damaging counter as the tit for tat conflict continued to escalate.

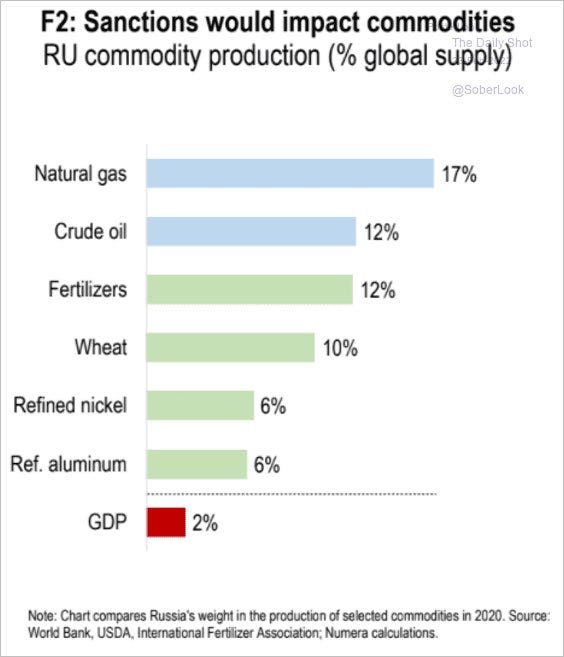

This could take the form of cutting off gas supplies to Europe, limiting oil exports to countries supporting sanctions on Moscow, or any number of other trade actions where Moscow holds significant leverage.

According to an analysis done by JPMorgan in January, an interruption to supplies of oil from Russia could send the price of oil (Brent) to $150 a barrel.

In short, the West levelling that degree of sanctions on Moscow could trigger a damaging wave of inflation around the world in any number of products from food to gasoline.

This will come at its own political cost to Joe Biden’s admiration and those nations which support the sanctions, but at least now they will have a credible scapegoat for inflation in the eyes of the public.

But amidst the potential for a stagflationary shock, there is another path the West and the Biden administration could potentially take in an attempt to protect markets and reduce the risk of setting off an inflationary wave, a more limited sanctions response that doesn’t trigger a large scale escalation from Moscow.

In this scenario where Russia’s invasion is effectively waved away in relative terms and the West instead places an emphasis on bolstering its NATO allies, there are potentially dangerous consequences.

By doing relatively little despite the threats of a furious response to any large scale Russian incursion into Ukraine, the West would look weak in the eyes of its allies and its enemies.

The West’s inability to hold to its word would echo around the world, from emboldening aggressive governments to launch strikes on their own enemies to China suddenly seeing Taiwan in a very different light amidst a backdrop of the West’s percieved weakness.

There Are No Good Options

Today the world collectively stands at a fork in the road.

Down one path is emboldening dictators and authoritarian strong men to do as they please under the assumption that the West might just let them get away with it.

Down the other is the potential for high global inflation driven by sanctions and perhaps even a short rerun of the 1970’s oil crisis acting to entrench inflation for the long term.

Neither option comes without costs and risks, there are no more easy path’s left.

In the coming days and weeks, the decisions made in the halls of power will set the tone for years to come. We could see a rerun of relative appeasement in order to protect a vulnerable economy like during the 1930’s or this time the West may choose to act more aggressively to maintain its credibility and risk setting off long term inflationary pressures.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Thank you for your readership.