A Perfect Storm for the Economy and Corporate Earnings - Stuck Between Inflation and Deflation?

War, supply chain issues and waning consumer demand make for a concerning picture for U.S corporates.

In the more than two years since the Covid-19 pandemic began the world has been transformed from one effectively built on low inflation, to one where uncertainty and inflation have become defining characteristics for the global economy going forward.

But while there are arguably long term inflationary pressures beginning to become entrenched, the disinflationary and even outright deflationary forces that defined the world pre-Covid have not ceased to be a potential part of the puzzle either.

As inflation continues to bite and consumer demand begins to moderate, we are beginning to see the potential for a temporary coexistence of inflationary and deflationary forces within the real economy.

Throughout much of the pandemic, supply chain issues and intermittent shortages proved challenges for U.S retailers, as they attempted to keep up with the high level of demand driven by displaced services spending and the impact of trillions of dollars of government stimulus.

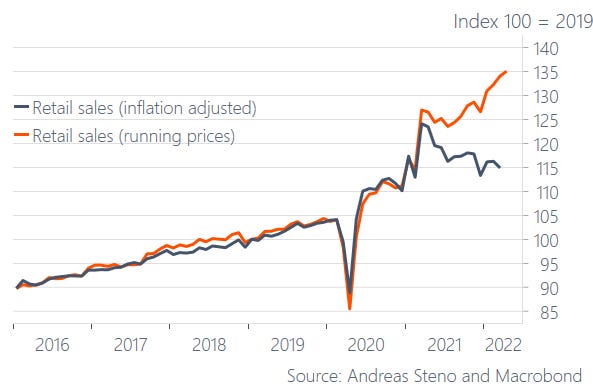

Yet despite the generally bullish outlook on the long term prospects of the U.S economy which persisted until relatively recently, in inflation adjusted terms U.S retail sales peaked over a year ago, following the last stimulus checks from the Biden administration.

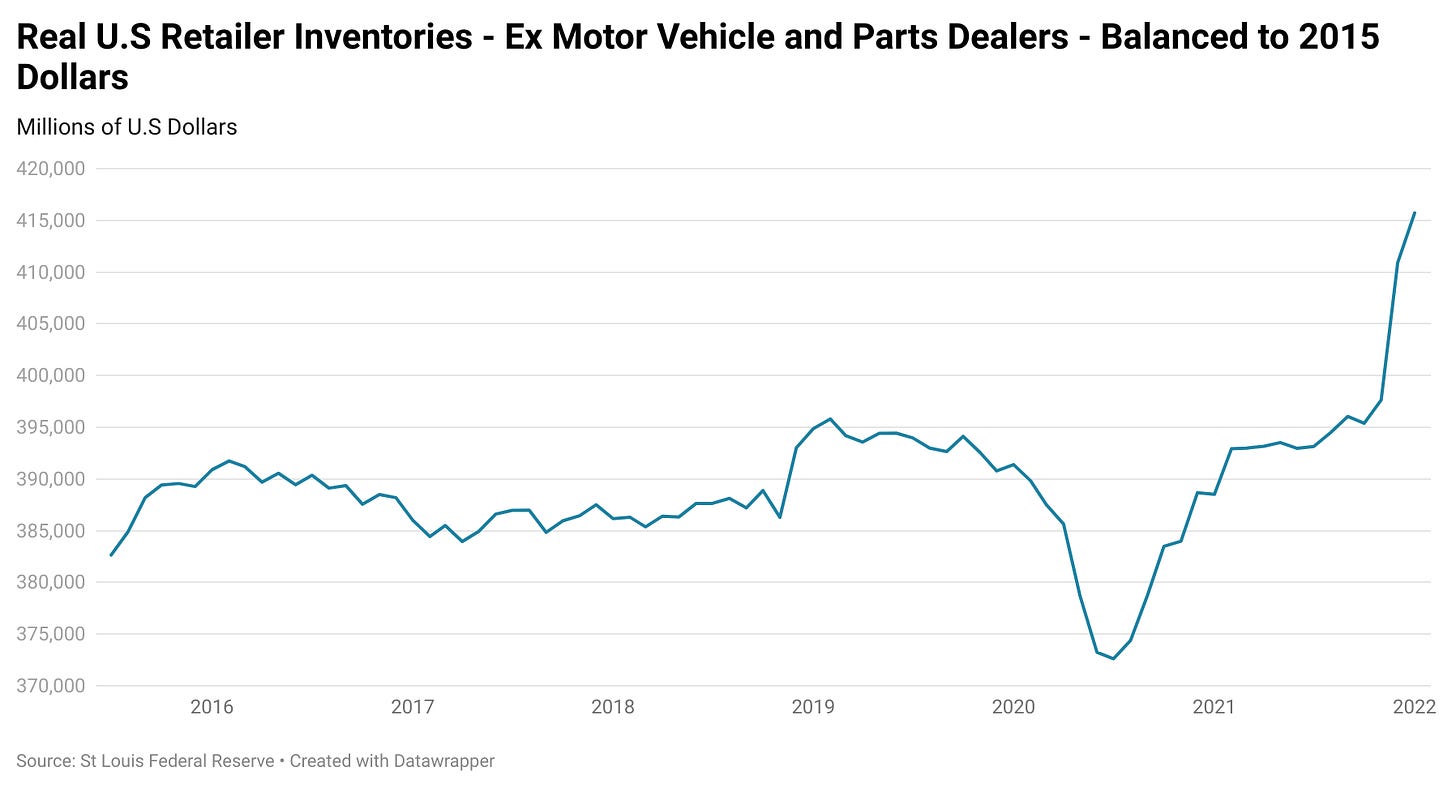

Large Retail Inventory Builds

In the months that followed inventory levels remained relatively stable, until the final quarter of last year. Then seemingly all of a sudden, retailers inadvertently began one of the largest inventory builds in American history. In just a few months U.S retail inventories grew by more than 5% in inflation adjusted terms.

To put this into perspective, between mid-2015 and the pre-pandemic peak in retailer inventories (ex-autos) in June 2019, total inflation adjusted inventories grew by just 2.8%.

Leaving aside for a moment the strong possibility that inventory levels could continue to grow, even current stock levels could force retailers to discount items if the expected demand fails to materialize.

The early signs coming from large U.S retailers suggest that expected demand may not end up materializing.

According to a report earlier this week from Bloomberg, Amazon is stuck with too much warehouse space that it built up during the pandemic as it attempted to match demand driven by displaced services spending and government stimulus.

It is believed that Amazon is now looking to sublet at least 10 million square feet of warehouse space and may vacate even more by ending leases with landlords.

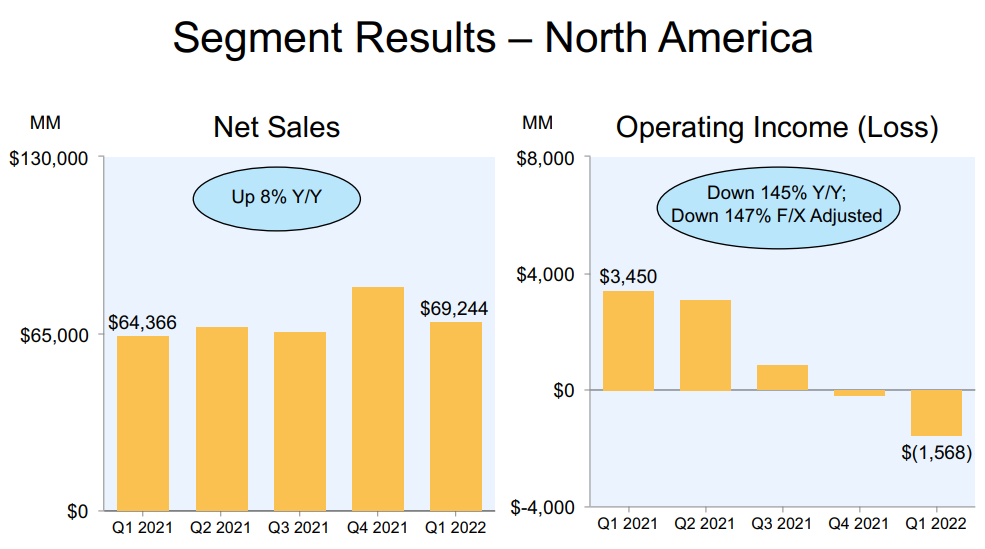

With net Amazon sales in North America practically flat year on year after factoring in the impact of inflation and operating income experiencing a fall of $1.57 billion in Q1, this is hardly the strength retailers with large inventory builds would be hoping to see.

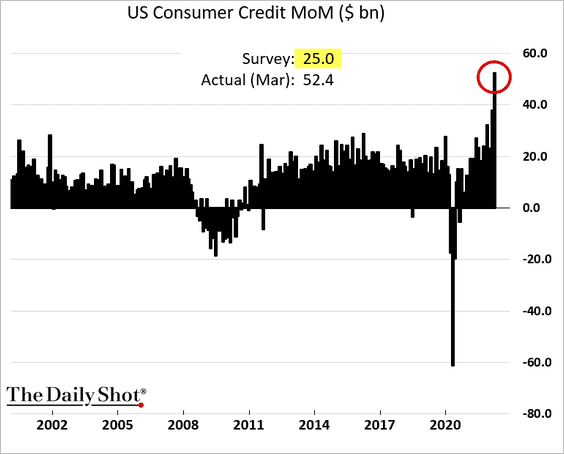

Demand Propped Up By Consumer Credit Growth

Despite the headwinds provided by a slowing U.S economy and rapidly rising inflation, so far U.S consumers appear to be turning to spending their savings and using their credit cards.

U.S consumer credit growth recently surged to all time high’s and significantly exceeded analysts expectations. The most recent data for April showed U.S households taking out more than $52 billion in revolving consumer credit (credit cards etc).

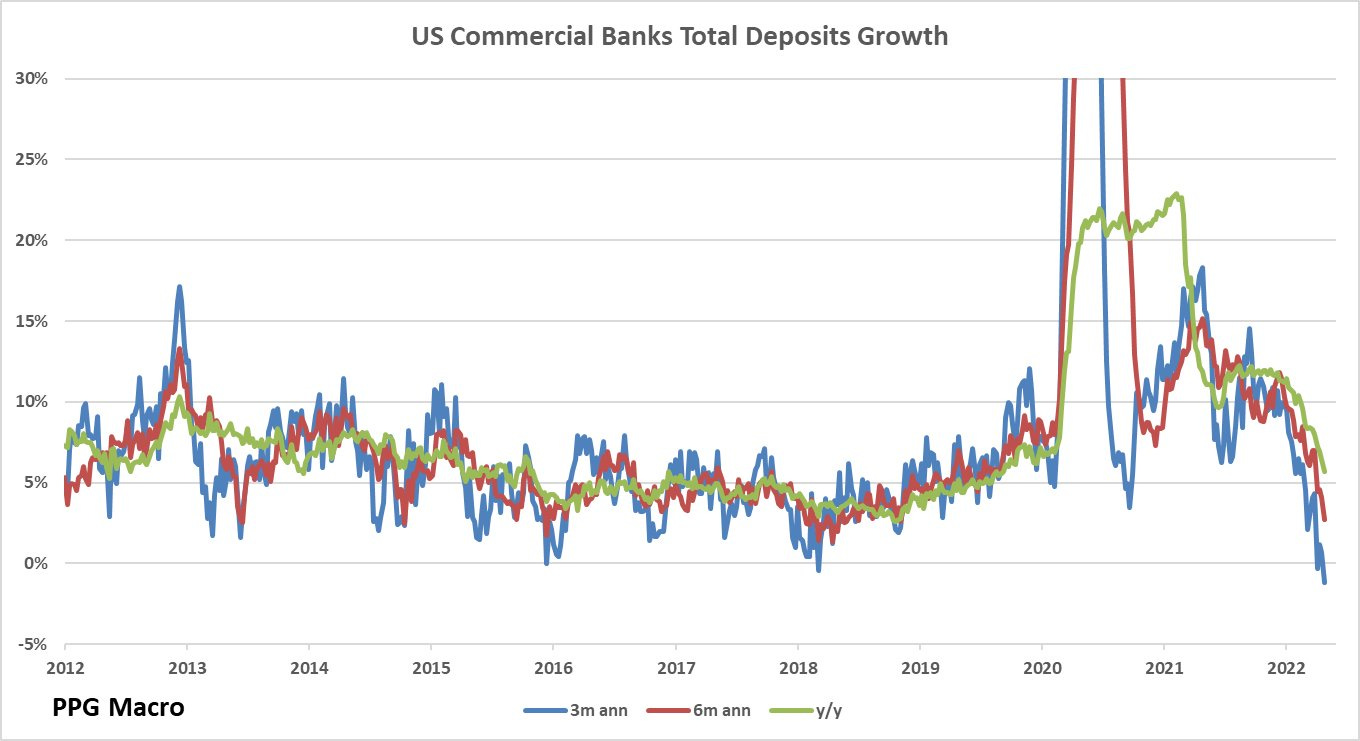

Meanwhile, U.S commercial bank deposit growth has turned negative on a 3 month annualized basis. Considering that this is an aggregate figure that likely includes more well off households continuing to save while lower income households expend their savings, its quite a concerning sign for the medium term future of the U.S consumer economy.

Ultimately, American households can only rely on expanding credit card balances and savings for so long, eventually enough will be tapped out that demand within the consumer economy will fall significantly.

Industrial Inflationary Pressures Continue

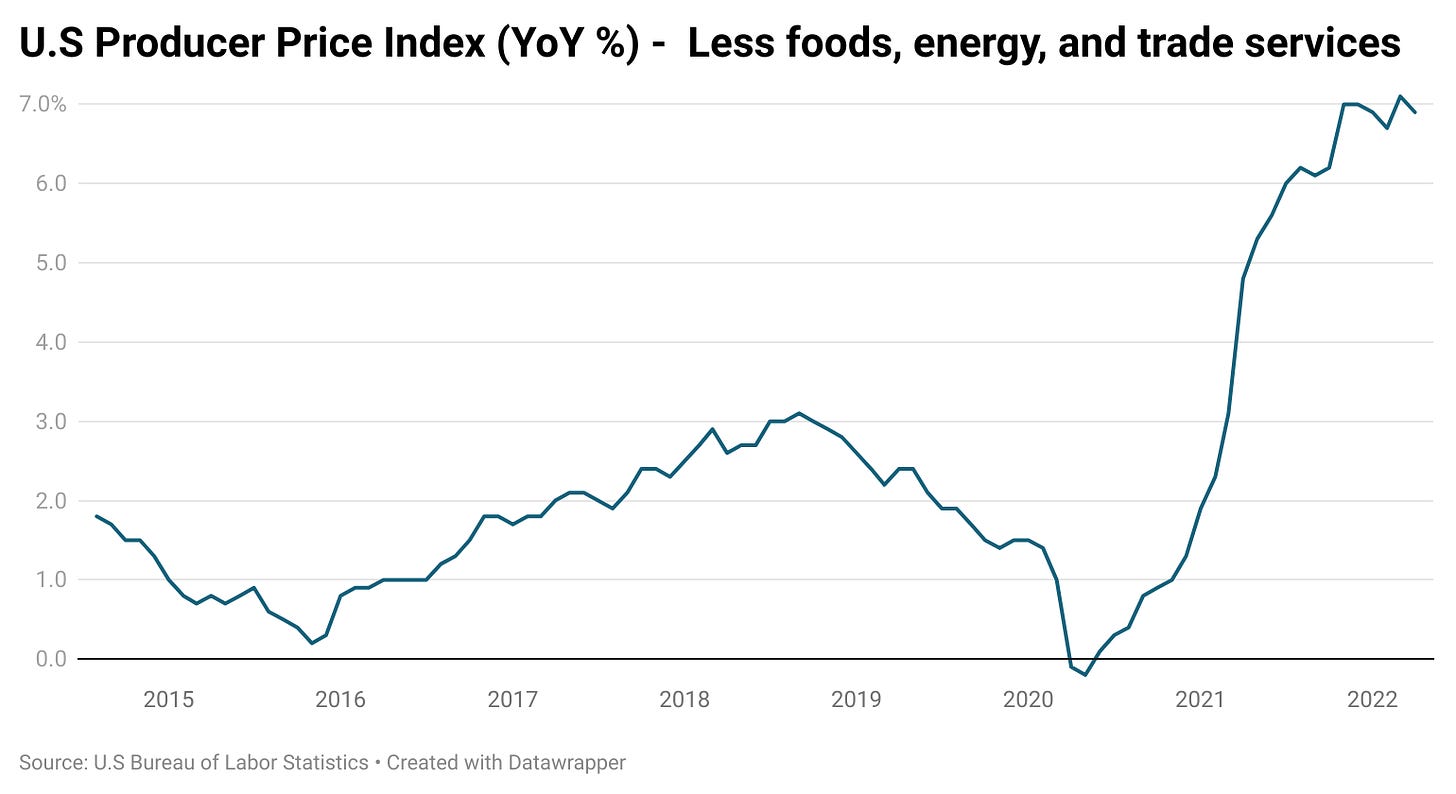

While there are some who have called the top for inflationary pressures after the recent U.S CPI data revealed that inflation had fallen from 8.5% YoY to 8.3%, in the world of companies that actually produce goods its quite a different story.

Once you strip out volatile items such as food and energy, it shows that the U.S Producer Price Index (PPI) is actually bouncing around within the same range it has been in since November last year.

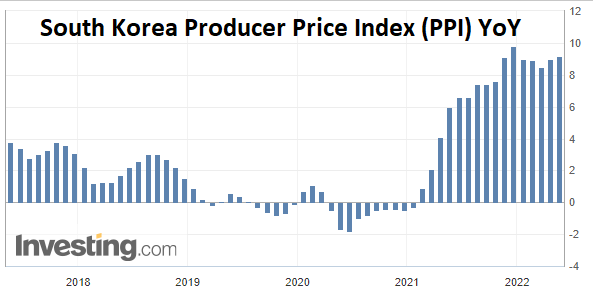

Across the other side of the Pacific, the South Korean PPI is showing a similar trend of inflationary pressures becoming entrenched. Despite peaking in December it has continued to remain in a similar range in the same way the U.S PPI has.

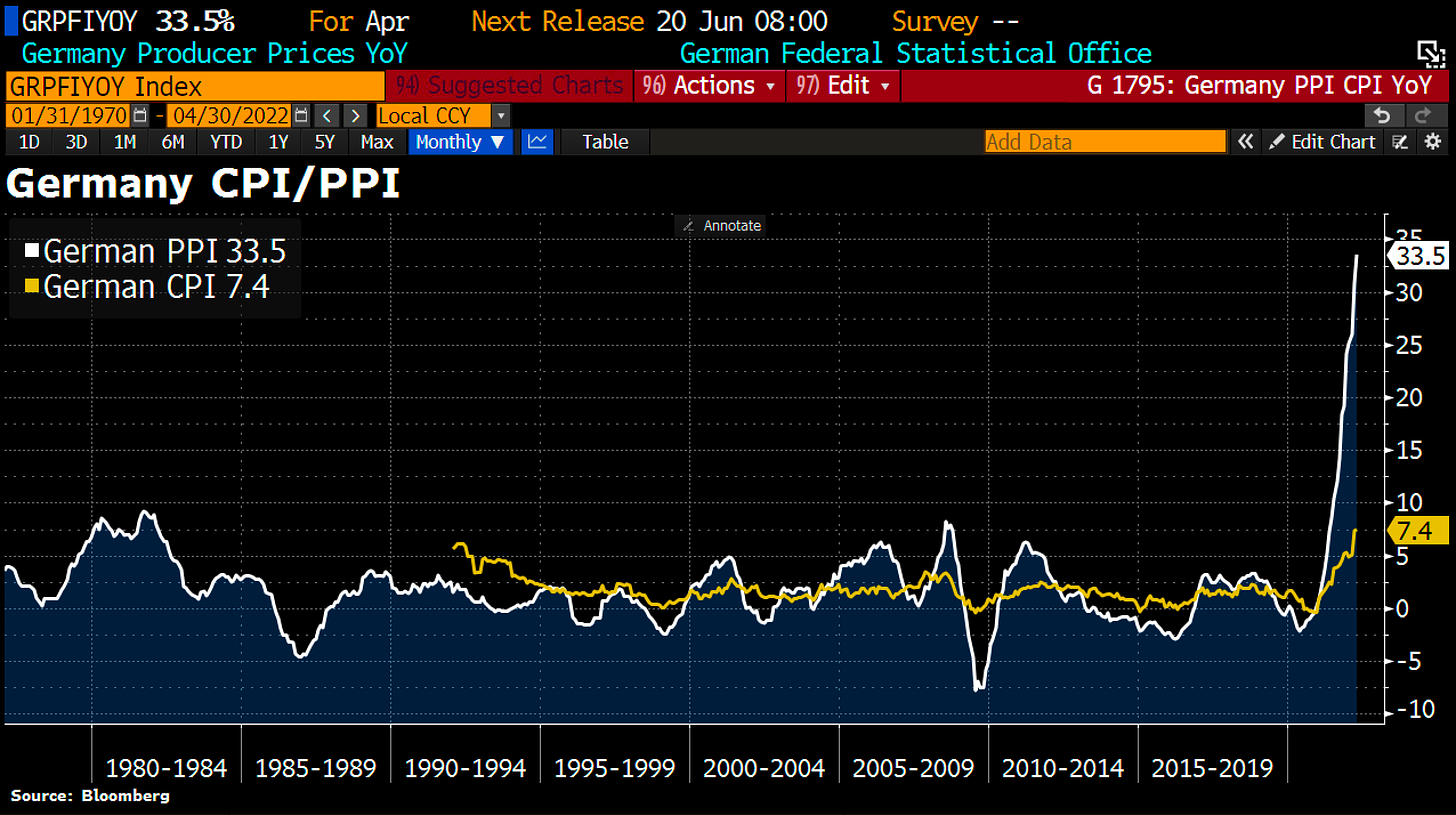

Meanwhile, in Germany, its PPI recently hit a record high of 33.5% year on year. The previous all time peak before the recent rise in inflationary pressures was 14.6% recorded back in June 1974 amidst the impact of the oil crisis.

Suffice to say that pretty much wherever you look in the world manufacturers and producers are experiencing rapidly rising input costs. While these pressures will eventually weaken over time, for the moment it seems unlikely they will weaken swiftly enough to make a large degree difference in the short term.

Inflation And Deflation

In short inflationary pressures for manufacturers remain entrenched and are currently showing little sign of moderating toward levels consistent with the long term trend.

While that may change if commodity prices fall significantly and we see a broad based slowdown within the global economy, for the moment we appear set to see inflationary pressures continue for manufacturers while retailers may face deflationary pressures on a sizable proportion of their inventories.

This brings us to the impact on corporate earnings.

In this the math is rather simple, if inflationary pressures continue to drive an ongoing rise in the cost of goods and weakening demand forces discounting due to a large inventory build, all else remaining equal, the result is falling earnings and profitability.

We are already seeing early signs of the impact of discounting and continued inflationary pressures on the results of major U.S retailers.

Analysts expected Target to earn $3.07 per share in Q1, which already represented a 26.6% fall in earnings compared with Q1 2021. In reality it delivered earnings of just $2.19 per share.

It was a similar story at Walmart, where earnings came in at $1.30 per share, disappointing analysts who had expected $1.48 per share. In Walmart’s earnings report they lowered forward profit expectations and also gave this explanation for falling earnings:

"bottom-line results were unexpected, and reflect the unusual environment. U.S. inflation levels….created more pressure on margin mix and operating costs than we expected."

These results also pre-date the impact of the war in Ukraine and lockdowns in China, so there are significant further inflationary pressures that are yet to feed into U.S corporate earnings.

Ultimately if there is insufficient consumer demand to absorb the elevated level of retailer inventory’s, corporate earnings will continue to face downward pressure for the foreseeable future.

These factors represent what is basically a perfect storm for American corporates, who have long become adjusted to non-existent goods inflation (which I covered in a previous article) and just in time supply chains functioning as originally intended.

Exactly how large of a hit impacted U.S corporates take remains to be seen, particularly with record levels of consumer credit creation muddying the waters, but one can conclude with a reasonable degree of certainty that major challenges lay ahead.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.