A New Peak In Oil Prices Could Keep Inflation Higher For Longer

Any ideas of a dovish pivot by central banks could be brought undone by a protracted period of higher oil prices

From the debate about the ultimate course of inflation to the stability of nations around the world, its all influenced by one key factor, the price of energy, particularly oil and gas.

In some past economic cycles the peak in the price of oil was followed by the peak in CPI inflation in year on year terms shortly after.

This was the case in 1990 and in 2008, with oil taking a big dive lower in both instances.

As speculation continues to build that the U.S has passed peak inflation, this leaves the rather large potential elephant in the room, oil prices.

What if through a combination of factors such as the war in Ukraine, self sanctioning and an imbalance between supply and demand, oil prices have not in fact peaked and a higher high still remains ahead?

But let’s examine the data we do have to support that theory and you can come to your own conclusion.

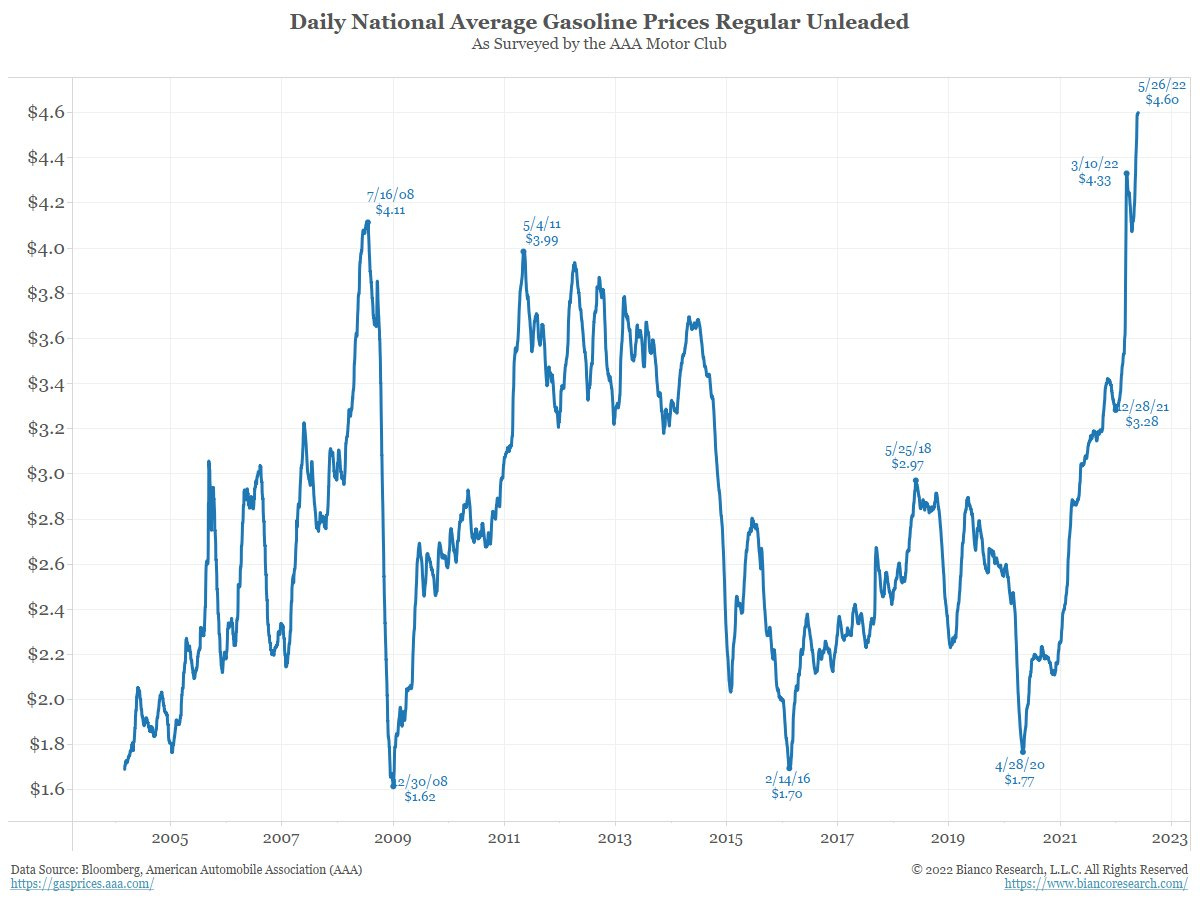

Gasoline prices have decoupled from oil prices

Despite oil prices peaking over 2 months ago, the average price of U.S gasoline is 6.2% higher now than when the peak of oil prices was recorded. With the summer driving season ahead and Americans expected to hit the road in droves, the peak in gasoline prices may still be months ahead of us even without further rises in oil prices.

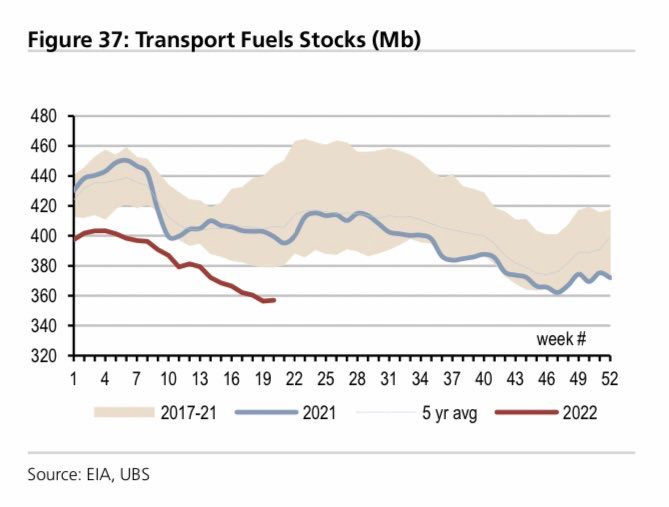

U.S transport fuel inventory’s at historic lows despite refinery’s running hot

While there are arguably a number of different reasons for this decoupling between oil and gasoline prices, chief among them is the relatively low level of transport fuel inventory’s in the United States.

Currently transport fuel stocks are running well below their 5 year average and are failing to make much headway in terms of an inventory build prior to the summer driving season.

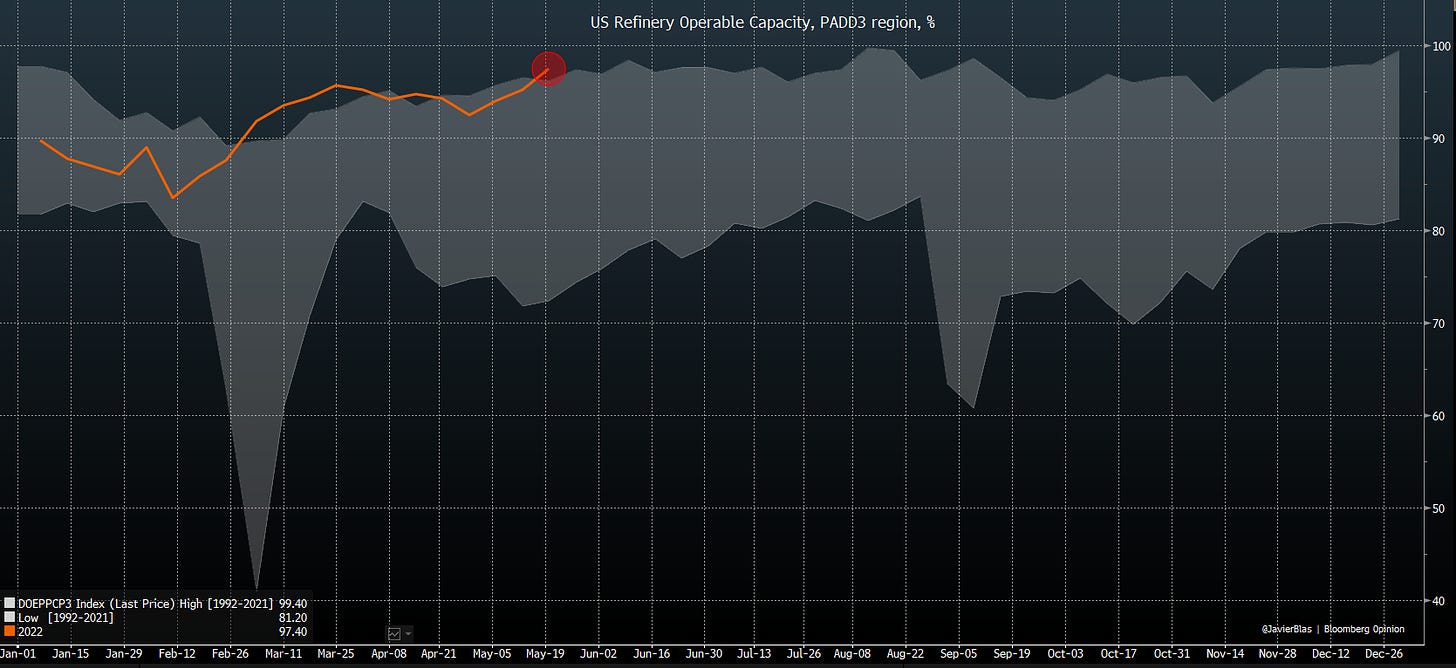

This comes in spite of U.S East coast oil refineries running at near 100% capacity and above historic levels of operation for this time of year across the last 30 years.

This inability for the U.S to build up greater reserves of transport fuel inventories has prompted concerns about a shortage of diesel. As a result, the Biden administration is reportedly considering releasing diesel from U.S strategic reserves for only the second time in American history. The other being undertaken in the wake of Hurricane Sandy in 2012.

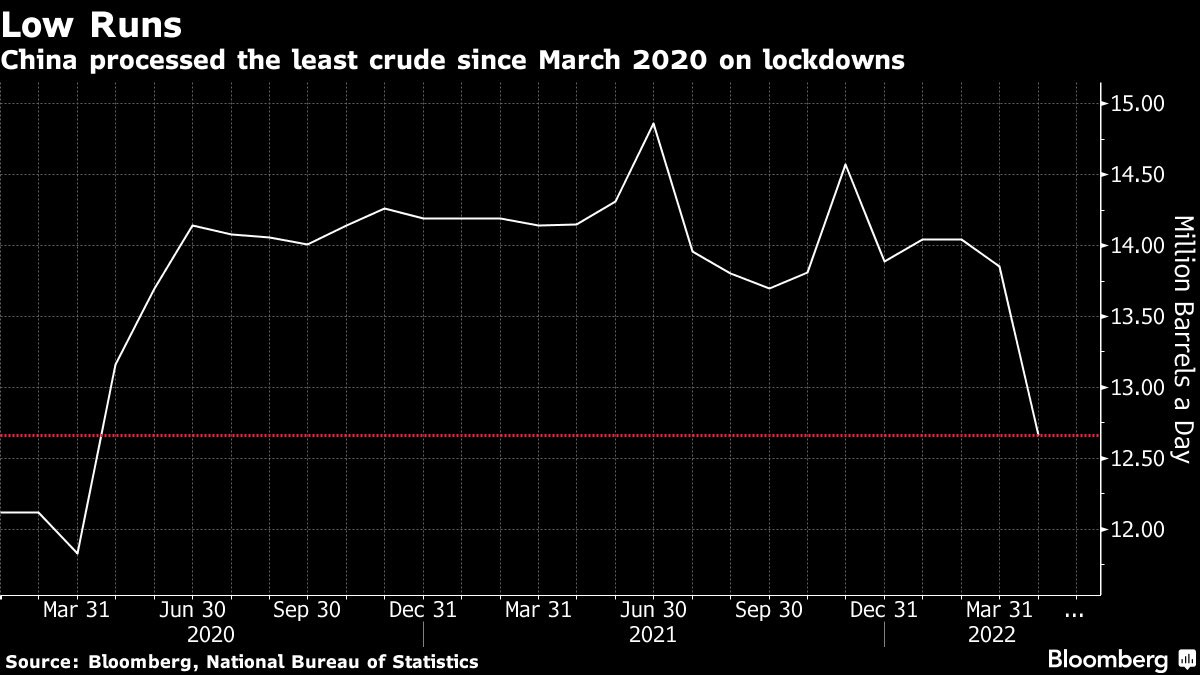

The China factor

As gasoline and diesel prices across the United States and much of the world continue to make new highs, its important to keep in mind that this is taking place amidst the backdrop of significantly lower levels of Chinese oil consumption due to the impact of lockdowns.

In recent weeks the Chinese refinement of crude oil into diesel, gasoline and other distillates hit its lowest level since April 2020, a time that was defined by the world’s first 21st century national lockdown.

This is more than 2 million barrels a day lower than the peak in distillate refining recorded in late Q2 last year.

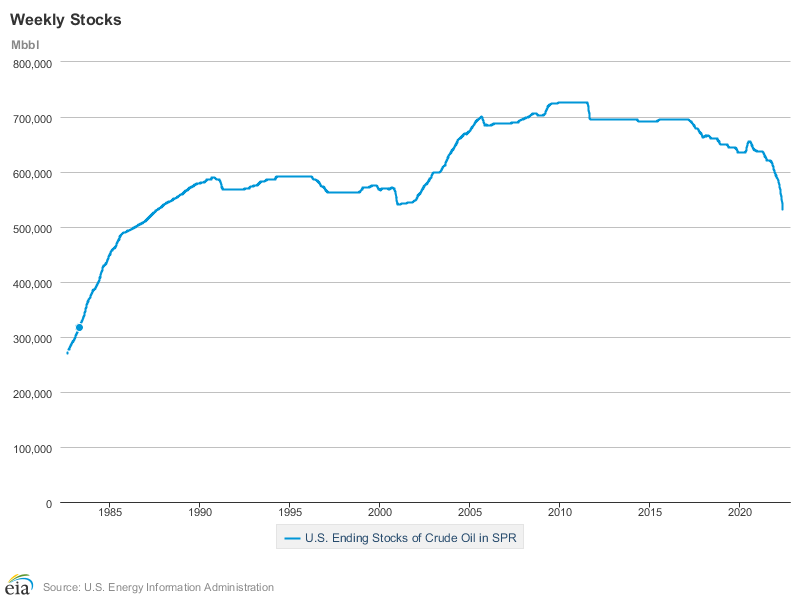

Releases from the U.S Strategic Petroleum Reserve (SPR) continue

Amidst the relative strength of oil prices in spite of the lockdowns in China, the release of U.S strategic oil reserves has continued at 1 million barrels per day or roughly 1% of average global consumption.

While this arguably does not provide major downward pressure on broader oil prices, it is providing some degree of support in prices not going even higher than they already are.

But in the not too distant future this will come to an end. If all goes as scheduled, by the end of September the release of reserves will end and this particular headwind for oil prices will be gone.

If the Biden administration chooses to refill the strategic reserve in the months that followed for any number of reasons such as preparation for a major natural disaster or a global conflict, the SPR would suddenly become supportive for upward pressure on oil prices rather than a headwind.

The Outlook

When you put all these factors together, its clear that oil prices going higher than their early March peaks is well and truly a possibility.

New high’s in oil prices could drive higher inflation expectations and higher bond yields, potentially offering a chance for the U.S 10 year yield to exceed its previous peak of 3.2%.

Then there’s the political side of the equation. Gasoline and diesel prices are the defining inflation metric for the American people, their declining purchasing power is quite literally up in lights every few miles, a reminder the economy is no longer working for them.

While its possible that somehow headline CPI may roll over without a corresponding large decline in oil prices, the reality is as long as they remain high, inflation as the American people see it and live it will remain a defining political issue.

With the midterms now just a little over five months away and polling looking poor the incumbents, the politically motivated drive for the Federal Reserve to address inflation is arguably stronger than ever.

And all of this is before we have even started to delve into the details of the new EU ban on a large proportion of Russian oil exports.

Ultimately, the future of oil prices is a key element in the future of inflation expectations and of markets. If they continue to stay high despite parts of Europe flirting with recession and a significant slowdown in the U.S economic growth, central banks will have even greater problem.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

Awesome!

Great article mate, really gets you thinking that central banks and Governments may be wedged between a rock and hard place. It will also be interesting to see how this affects claimate change policy and rate of change to renewables as there will be push to drill for more oil.

Side question will the government look at restoring Australia's refinerie?